The couple tried to file their taxes at the local library through a program for senior citizens through AARP, but instead of a free tax filing, they learned their tax refund is gone.

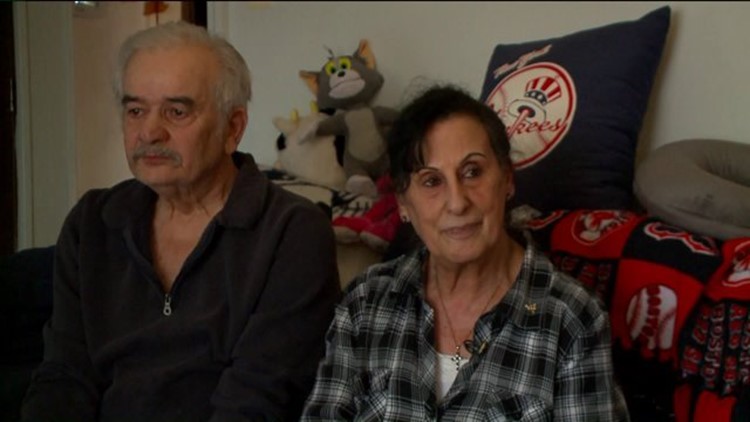

"It's been a nightmare,” said Anne Marie Oddo.

Her husband Leo was born in Italy, but the couple’s lived in Southington for 20 years now.

Two weeks ago he took their forms to the library, but learned that someone had already filed in his wife’s name, using her social security number.

"I was pissed off a little bit... you know,” said Mr. Oddo.

They called the IRS, local police, etc. and were told to mail in a paper return and an “identity theft affidavit”.

After speaking with police, it’s still unclear exactly how this happened to them, but Leo thinks it could be connected to the recent health insurance breach.

Either way, their plans to purchase new couches with the $2800 return are on hold.

"We were going to buy a whole new set here but... you know... stuff like that... but, forget it now,” said Mrs. Oddo.

The entire family describes a feeling of embarrassment almost like they were the criminals, even though the Oddos did nothing wrong.

"I didn't really imagine that it would happen to somebody like them...” said daughter, Patty Mason.

But the family is not the first Connecticut family impacted by identity theft and likely won’t be the last.

Now, all they can do is mail their paperwork to the IRS and hope for the best.

"I'm one of the many people that had this problem and you know, it's not right, it's not right that somebody does this… I just hope they find who did it,” said Mrs. Oddo.

On Wednesday the family contacted Fox CT to tell us that their health insurance company offered two years of free credit monitoring for Mrs. Oddo after the recent breach.

The IRS provided FoxCT the following information:

The IRS continues to aggressively pursue the criminals that file fraudulent returns using someone else’s Social Security number. We urge people to protect their computers and only give out their Social Security numbers when absolutely necessary. As a result of the IRS efforts to combat identity theft, from 2011 through October 2014, the IRS has stopped 19 million suspicious returns and protected over $63 billion in fraudulent refunds.

If you have been a victim of tax-related identity theft follow these steps:

- File a police report File a complaint with the Federal Trade Commission (FTC) at identitytheft.gov or the FTC Identity Theft Hotline at 1-877-438-4338

- Contact one of the three credit bureaus to place a fraud alert on your account

- Complete IRS Form 14039, Identity Theft Affidavit Continue to your file tax return, even if by paper