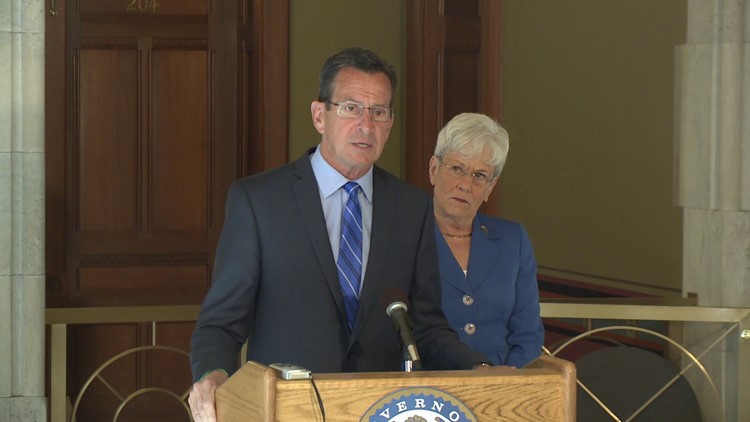

HARTFORD -- Calling the just-finished session good and challenging, Gov. Dan. Malloy said he was pleased with gains made in property tax reform and transportation infrastructure funding.

Malloy said, "I produced a balanced budget, I'm not the legislature," as he pointed out that the cuts he made were restored in the budget process.

He said the budget as passed allows the state to make progress on his long-term transportation initiatives. However, he took both Republicans and Democrats to task for restoring funding to many of the social service programs that Malloy had cut in his original budget proposal, including mental health care and services for people with disabilities. It also restored funding for state parks and UConn.

Democratic legislative leaders on Wednesday were able to push through a two-year, $40.3 billion budget on the final night of the legislative session, despite opposition from some lawmakers in their own party, Republicans and some of the state's major employers.

Malloy said he has had discussions with corporate leaders from Aetna, GE, and Travelers about their concerns over tax increases and labeled some of the issues as miscommunication, but the companies did not see it that way.

Elected leaders have failed to address the state’s budget obligation responsibly. But it’s Connecticut’s businesses and residents that will pay the price. Aetna currently pays approximately $65 million each year in taxes to the state. Once this new budget is fully implemented, our tax burden increases by approximately 27 percent annually. Taxes like the tripling of the computer and data processing tax hurt our ability to remain competitive and invest in our employees and customers.

--Aetna

Minutes before the General Assembly's deadline to adjourn, the Senate voted 19-17 in favor of the package, which raised a range of taxes by about $2 billion over two years, including the personal income tax for wealthy residents and various business taxes.

The Senate and the House adjourned shortly before their midnight deadline but both voted to return, possibly in a couple of weeks, for a special session to finish some budget-related bills and other legislation that got caught up in the turmoil as the session was winding down, including Malloy's so-called Second Chance Society legislation that, among other things, reclassifies use and possession of drugs as a misdemeanor.

The budget now goes to the Democratic governor, who decided to forgo his traditional address to the General Assembly following the adjournment.

The fiscal package cleared the House of Representatives on a 73-70 vote earlier in the day. That vote followed a night of marathon deal-making by Democratic leaders. Seventy-two votes were needed to pass the bill.

Senate Minority Leader Len Fasano, R-North Haven, was exasperated with the whole process. The GOP was not included in the closed-door budget talks between the legislative Democrats and Malloy's administration, despite offering their own budget proposal.

"We are frustrated and we should be frustrated. That's not the process we signed up for," said Fasano.

The tax increases in the bill come four years after the General Assembly voted to increase taxes by approximately $2.6 billion over two years to help cover a budget deficit -- a problem that continues to dog the state.

The close tallies highlighted the strong differences of opinion about whether Connecticut is making the right decisions to try and fully recover from the national recession.

For first time in recent memory, some of the state's major employers publicly criticized the budget package, urging that it be rejected. Connecticut-based General Electric Co., Aetna Inc., the Travelers Companies Inc. and pharmaceutical company Boehringer Ingelheim each released rare public statements taking issue with about $700 million in business tax increases.

GE and Aetna both questioned whether they would remain in Connecticut, and GE even sent a letter to all employees about a possible move:

As a result of this law passing, I have assembled an exploratory team to look into the company’s options to relocate corporate HQ to another state with a more pro-business environment. This will be a thoughtful process which will take many factors, especially employee impact, into consideration. As the team makes progress, we will keep you updated.

We only consider this after a lot of thought and in the context of our ability to compete. GE is a major employer in the state. We purchase $14 billion in goods and services from Connecticut companies. Despite this, we have had a tough past decade in Connecticut. Our taxes have been raised five times since 2011, while support for our strategies has been uneven. I believe we should pay our fair share and that all of us should give back to our communities. But, we can compare Connecticut with other states where small and large businesses have a better environment to thrive and compete.

Democrats defended the package, saying they were proud of how it addresses transportation funding and provides structural reform to an unfair tax system by placing a cap on local car taxes.

"Change is tough. No question about it. And it's not free," said Sen. John Fonfara, D-Hartford, co-chairman of the legislature's Finance Revenue and Bonding Committee. "But we believe the benefits of these changes will reward our economy for years to come."

The budget includes $19.8 billion in spending for the 2015-16 fiscal year and $20.5 billion in 2016-17.

The bill also sets into motion Malloy's major initiative for the legislative session: overhauling the state's transportation infrastructure. Earlier this year, he proposed a 30-year, $100 billion package that addresses roads, bridges, rail, ports and other transportation needs. The Democratic budget sets aside half of 1 percent of the 6.35 percent sales tax to help pay for the state's transportation expenses.

The other half of one cent is earmarked for local property tax reform. Local taxes on motor vehicles is capped at 32 mills in fiscal year 2017 and 29.36 mills in fiscal year 2018. One mill is equal to $1 for every $1,000 of assessed property.

In addition to the Second Chance Society, lawmakers plan to return to vote on a bill that addresses excessive force by police, including funding for body cameras. Meanwhile, it appeared other bills would not get a reprieve, including new regulations for ride-sharing companies like Uber; the ability for electric carmaker Tesla Motors to open three stores in Connecticut; and the removal of guns from people who have temporary restraining orders against them.

Legislators this session already voted to ban powdered alcohol, overhaul the local elections system, allow bow-and-arrow hunting on Sundays on certain private property and subject electronic cigarettes to the same restrictions as tobacco cigarettes, among many other bills.

Lawmakers also approved a bill that creates a two-step process for possibly allowing a third casino in Connecticut. The jointly run facility would be operated by the Mashantucket Pequot and Mohegan Tribes and located in north central Connecticut. The tribes now plan to seek proposals from interested host communities and eventually return to the General Assembly for final approval, possibly next session.