NEW YORK — Americans with lower credit scores are falling behind on auto payments at an alarming pace.

The rate of seriously delinquent subprime car loans soared above 5 percent in February, according to a Fitch Ratings review of loans that are packaged and resold on Wall Street. That’s worse than during the Great Recession and the highest level since 1996.

Subprime loans are those given at higher interest rates to borrowers who have lower credit scores.

It’s a surprising development given the relative health of the overall economy. Fitch blames it on a dramatic rise in the availability of loans along with lax borrowing standards that have helped fuel the recent boom in auto sales. More Americans bought new cars last year than ever before as the amount of auto loans soared beyond $1 trillion for the first time ever.

But research conducted by a group that tracks people’s credit scores, TransUnion, suggests that plummeting oil prices also has something to do with the rise in late payments, especially given the flurry of pink slips flying in the oil industry.

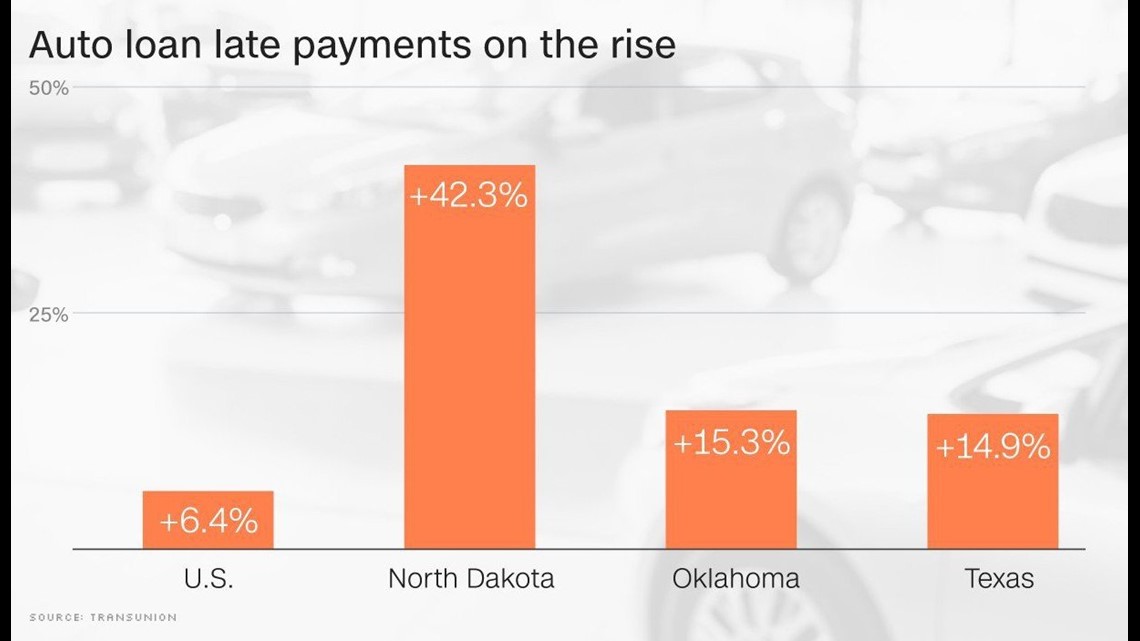

North Dakota, the epicenter of the shale oil boom and subsequent bust, experienced a 42 percent spike in seriously delinquent (60 days or more) auto loans during the fourth quarter, according to TransUnion. Louisiana, another state hit hard by the oil crash, had the highest auto delinquency rate, while late payments in Texas and Oklahoma jumped about 14 percent apiece.

To cope with the crash in oil prices, American oil companies like Chevron, ConocoPhillips and Halliburton have been slashing jobs aggressively.

By comparison, the overall U.S. economy continues to hum along, adding jobs at a healthy pace. So it looks like a cocktail of factors are leading to this — from easy credit and cheap gas along with the massive increase in auto sales.

Fitch points out that the subprime end of the market is also where there’s increased competition to peddle loans. The ratings firm flagged an increase in loans to “borrowers with no FICO scores,” lower downpayments, and extended term lending.

No wonder there was a 34 percent rise in subprime loan losses in February, though they remain below recession levels.

Fitch said auto loans to borrowers that have better credit scores remain “stable.” Losses are below historical averages and Fitch expects the auto loan market, including the subprime section, to improve this spring as borrowers get flush with tax refunds.

“Losses in the overall auto finance industry are just incredibly low,” said Lou Loquasto, automotive finance leader at Equifax.

Problems in subprime loans are bringing back bad memories of the mortgage meltdown that fueled the Great Recession. But there are major differences between the risks tied to subprime auto loans and the subprime mortgage fiasco of last decade.

First, unlike mortgages during the housing boom, auto loans aren’t sold as investment ideas that will make people rich. In fact, most people know that their vehicle will lose value over time. Plus, auto payments are often much more manageable than monthly mortgage payments.

Consumers also have a long track record of prioritizing their auto payments because they simply can’t afford to lose their car, which is their only way to reach jobs in most cases.

“You can always switch over and rent. But if you lose your car, you probably lose your job,” said TransUnion’s Laky.

Even if the auto-loan market isn’t facing a repeat of the 2008 crisis, worsening subprime credit problems could make it harder to get car loans in the future.

“It could have a spillover effect,” said John Bella, Jr., managing director at Fitch.