WASHINGTON -- The Internal Revenue Service will allow homeowners to deduct repairs to crumbling foundations through 2020. Previously, the deductions were only allowed up to 2017.

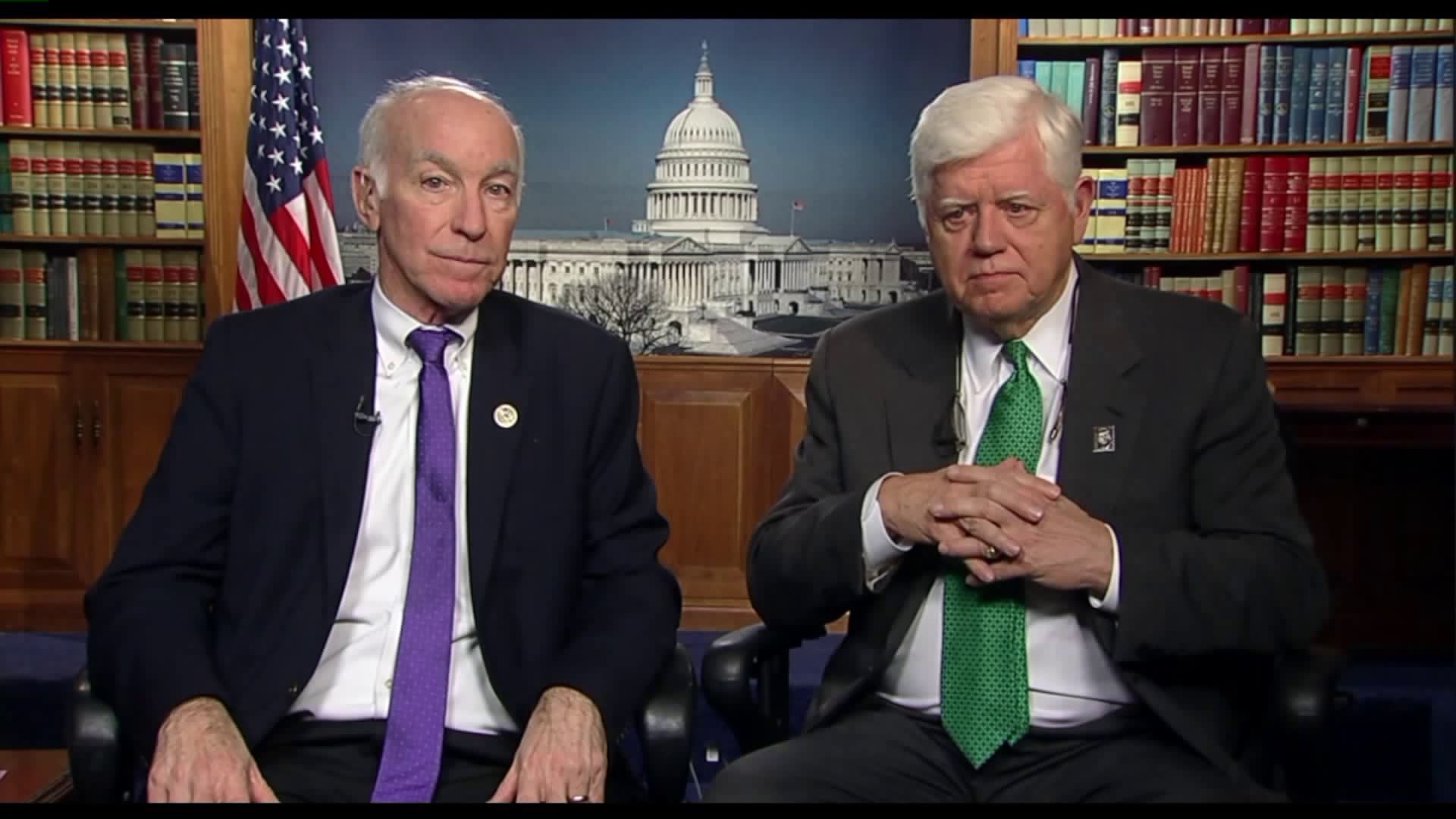

U.S. Representatives Joe Courtney, John Larson of Connecticut and Richard Neal of Massachusetts announced the revision Wednesday afternoon.

With the passage of the new tax law late in 2017, the IRS regulations had been in doubt.

According to the representatives, "The updated guidance from the Internal Revenue Service that extends the period of time that homeowners have to claim crumbling foundation related repairs on their federal taxes. Under the guidance issued today, homeowners will now have through the end of 2020 to make qualified repairs to their home and until April 2021 to claim those repairs on an amended 2017 federal tax return."