When Viacom’s Nickelodeon sketches its future for advertisers Wednesday, one of the elements it will touch upon will be its past.

As part of a presentation to promote its coming slate of programs, the kids-media empire (comprising several cable networks and more) will unveil a live-action TV movie inspired by its mid-1990s game show “Legends of the Hidden Temple,” as well as a two-part TV movie based on “Hey Arnold!” one of its best known animated series that ran between 1996 and 2004.

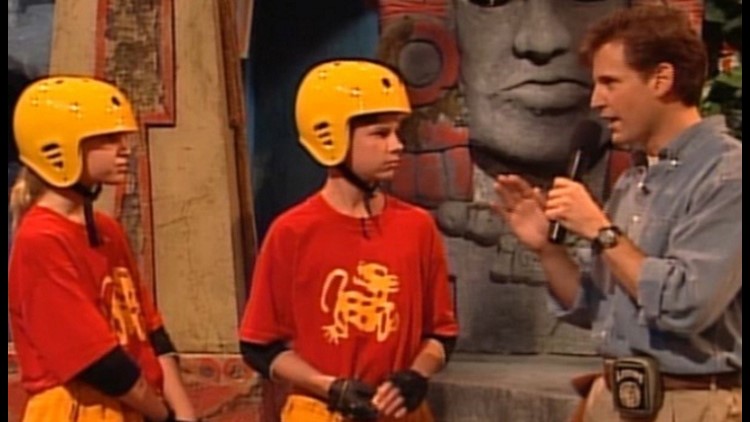

In “Hidden Temple,” three siblings must conquer a series of obstacles to remain alive, mirroring the theme of the original game show. The TV movie, slated to appear in the fourth quarter of 2016, will nod to other elements from the original show, including Olmec, a talking head who knows the secrets behind the temple; The Steps of Knowledge, the entrance to the temple and launching pad for the mission; and cameos from a green monkey, red jaguar, and silver snakes, among others. Isabela Monae, known from her role on Nick’s “100 Things To Do Before High School,” will star. The “Arnold” movies are slated to appear in 2017.

The company will also talk up a slate that includes what its top executive calls “happy reality” programs, like “All In,” an adventure docu-series led by Carolina Panthers quarterback Cam Newton and “Crashletes,” a half-hour series that will feature crazy viral sports clips. The programs downplay mean-spirited competition in favor of showing people having fun.

“There’s a tremendous amount of attention on kids these days. What that says is there’s a tremendous amount of opportunity — not unlike what is going on in the grownup space,” says Cyma Zarghami, president of Viacom’s cable networks aimed at kids and families, in an interview. “There is just more content everywhere.”

A lot of adults are relying on Nickelodeon’s kiddie fare. Viacom has been under intense pressure in recent months, as several of its flagship networks like MTV and Comedy Central grapple with viewership declines and investors question the strategy pursued by the corporation’s management. At Nickelodeon, however, ratings have improved. The network has seen its audience between the ages of 2 and 11 rise 4 percent in the first quarter of the year, according to analysis from Bernstein Research’s Todd Juenger, while Nick Jr.’s audience in that demographic has risen 57 percent. In doing so, the analyst said, the networks have taken share from competitors. Even so, Nickelodeon’s subscriber base and ad revenue shrank somewhat in both 2015 and 2016, according to data from market-research firm SNL Kagan, even as the subscriber fees it gains from distributors rose in both years.

“The company is under a lot of scrutiny, but I don’t think Nickelodeon is under any scrutiny at all,” says Zarghami a veteran programmer who joined the network as a clerk in 1986 and rose steadily through the ranks. “We have done a tremendous amount of work to build our ecosystem.”

Nickelodeon is in a different position than it was last year at this time, when Time Warner’s Cartoon Network was making ratings strides. Zarghami’s networks will vie with media outlets owned by Walt Disney, Time Warner and NBCUniversal for approximately $800 million in advance commitments from advertisers as part of a process known as the “upfront” market, when U.S. TV networks try to sell the bulk of their ad inventory for the coming season. The task has grown more difficult for kids’ outlets in recent years, as the rising generation of young viewers see little distinction between watching Nick series like “Bubble Guppies” on-demand and watching them on the network that launched it.

To lure those viewers, Zarghami and her executive team have put more focus on creating content – and not just for TV. “Game Shakers,” a series that debuted in 2015 centers on two young female entrepreneurs who devise apps, and makes their fictional creations available for real-life download via iTunes and other venues. The Nick and Nick Jr. apps have been downloaded on to 27 million devices, the company said, and Nick digital properties get 100 million views per month from kids.

Zarghami cites the pre-school audience as a primary factor in Nick’s recent ratings wins. “The pre-school audience does a tremendous amount of work to lift the 2-to-11 audience,” she says. “Alvinnn,” a new take on “Alvin and the Chipmunks” and perennial favorite “SpongeBob Squarepants” have helped attract audience, but Zarghami also pointed to series including “Blaze and the Monster Machines,” “PAW Patrol” and “Henry Danger” as successes.

The recent emphasis on reviving old Nick favorites was borne out of an idea from interns more than five years ago, she recounted. The interns thought the old programs would work well online, but Nick execs thought they might work well on TV, and put a block of the shows on Teen Nick at night. As original fans of 1990s fare adopted social media, she says, “interest in the Nick library was becoming louder and louder and louder.” Now executives hope to revive select concepts that will charm older fans but also spark new interest from their children.

Zarghami declined to reveal more of Nickelodeon’s programming slate, but hinted at a growing interesting in sports-themed programming and live events. The goal, she said, is to turn viewers into fans, who want to keep talking about shows even after an episode ends. “Once you can convert a viewer into a fan, you can have an ongoing conversation with them,” she says. Nickelodeon will spark that chatter later this week.