HARTFORD, Conn. — While overall inflation is statistically cooling down, Connecticut is still feeling a pinch in essential expenses that are higher than the national average.

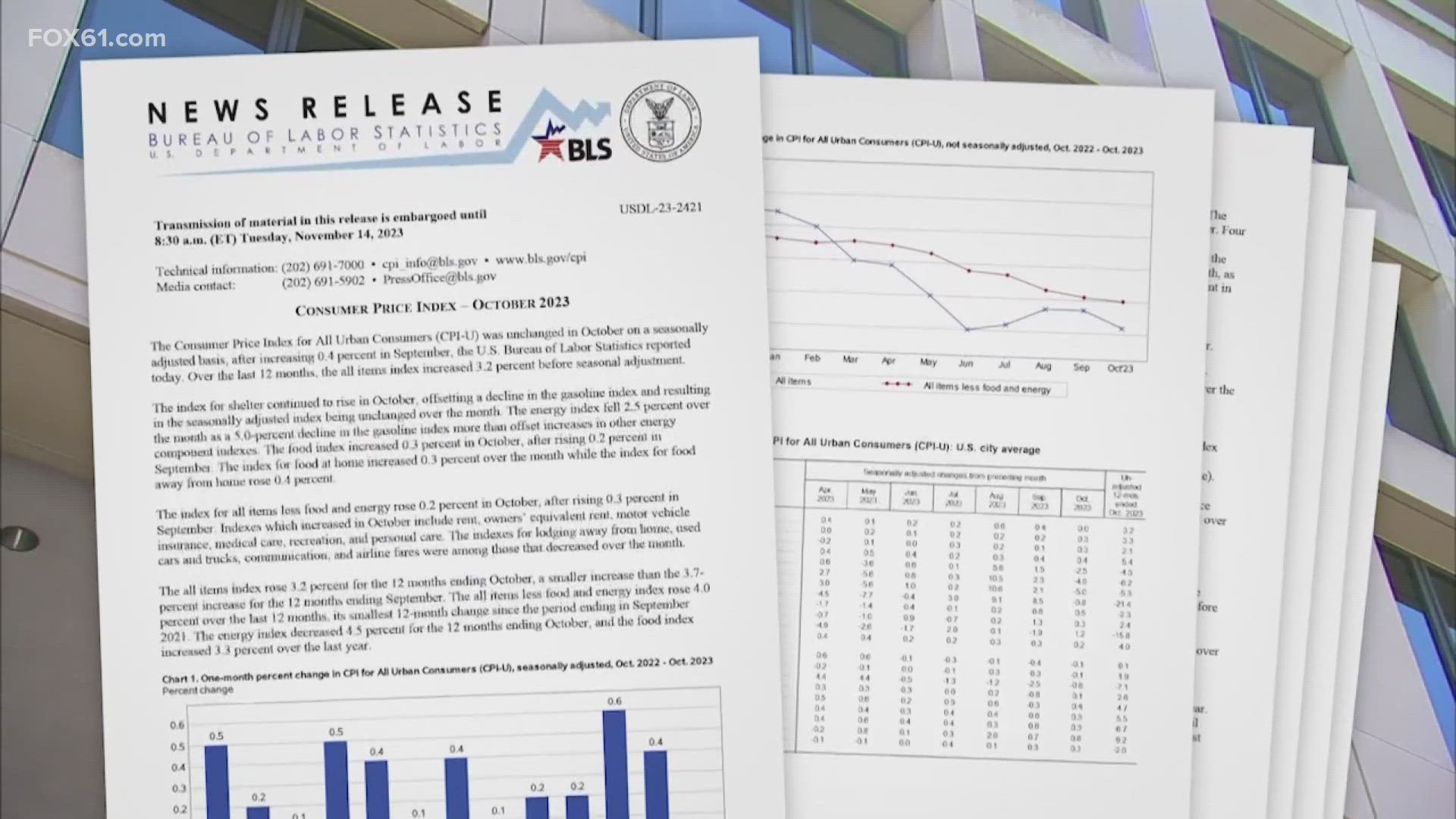

Consumer inflation in the U.S. eased in October, according to a report from the Labor Department. Overall inflation was unchanged from September to October; with that said, consumer prices went up just 3.2% from a year ago, down from 3.7% in September.

The average price for a gallon of gas is about $3.35, almost 30 cents down from last month.

“This is a good report. We know that the top line has been driven a lot by gasoline prices, energy prices in general. To see the core come down a little bit I think is good news,” said Douglas Holtz-Eakin, president of the American Action Forum.

The costs of other items, however, like shelter, medical care, and car insurance remain high. Prices for meat, fish and eggs also rose in October.

A new report from DoxoINSIGHTS shows Connecticut residents pay about 20% more for their monthly bills than the national average.

“Most consumers really are focused on the fact that prices have gone up even though their wages have gone up in a commensurate fashion,” said Jason Katz, managing director and senior portfolio manager at UBS.

The Doxo report shows that Connecticut residents pay around $2,500 a month, or 34% of their household income, for the 10 most common bills, for things like mortgage and rent, utilities, auto and health insurance, and internet. That's compared to the national monthly average of $2,046.

Core inflation, which does not include food and energy prices, rose 4% over the last year, which is the smallest 12-month change since September 2021.

“We're back into an era of productivity-led growth, the likes of which we've just forgotten about because we were in secular stagnation for 15 years,” said Donald Luskin, the chief executive officer of Trendmacro.

Inflation is still above the Fed's 2% target, but economists believe that Tuesday's report may give officials more confidence their policy changes are working and will deter them from taking further action and hiking rates more.

Chairman of the Federal Reserve Jerome Powell is keeping his options open, however, saying if it becomes necessary to tighten policy further, he won't hesitate to do so.

---

Have a story idea or something on your mind you want to share? We want to hear from you! Email us at newstips@fox61.com

---

HERE ARE MORE WAYS TO GET FOX61 NEWS

Download the FOX61 News APP

iTunes: Click here to download

Google Play: Click here to download

Stream Live on ROKU: Add the channel from the ROKU store or by searching FOX61.

Steam Live on FIRE TV: Search ‘FOX61’ and click ‘Get’ to download.