HARTFORD, Conn. — The federal government is offering two different loans for Small Businesses; The Economic Injury Disaster Loan (EIDL) from the Small Business Administration (SBA) and the Paycheck Protection Program (PPP) as part of the CARES Act.

FOX61News asked Jevon Gibb of Metro Hartford Alliance about what you need to know about both programs. Metro Hartford Alliance is holding a webinar on the new Paycheck Protection Program at 11 on Friday, April 3.

Economic Injury Disaster Loan (EIDL):

Q: How does the EIDL work?

A: The businesses submit their financial information, their revenues, [and] their budgets for the previous year and the SBA determines the amount needed to cover the operating expenses given the losses that they are experiencing. It’s kind of paternalistic system. Most borrowers are used to saying, “I want this amount”. They don’t ask for a specific amount under the EIDL. They provide their financial information and the SBA comes back and says, “We believe this is the amount you need. We are going to offer it to you over this term.” That term is between 20 and 30 years for most for-profit businesses. It’s going to be 3.75% interest

Q: Is the EIDL guaranteed?

A: It’s not. SBA says defer on the side of applying. Get the application in. They’re going to be very flexible with who they accept and they relaxed some of the requirements since it initially came out. But, it is not automatic as compared to some of the other programs.

Q: Who is eligible to apply?

A: It is for most small businesses under 500 employees. That’s the same for the Paycheck Protection Program (PPP) and the EIDL Advance. There are some additional restrictions with PPP, but all of these are aimed at small and mid-sized businesses under 500 employees.

Q: So, it’s like taking on a second mortgage?

A: It is and it’s very generous, especially considering the fact that it doesn’t require collateral under $200,000. It does require a personal guarantee, which is different than some business loans. So, you are personally on the hook for that loan. It’s not just your business. But, 3.75% at 20 to 30 years is nearly the inflation target, so it’s a great deal.

Q: Do I need to repay the loans? When?

A: You need to repay EIDL. It’s a 20 to 30 year term at 3.75% for for-profits and 2.75% for nonprofits. The SBA is releasing guidance saying they will delay payments until the end of 2020.

Q: There is also an EIDL grant for $10,000. Do I apply at the same time as the loan?

A: The new streamlined application that the SBA put online this week is the same application. You have an extra checkbox that you click for the EIDL advance. That’s the $10,000 grant that’s supposed to be dispersed in three days. I haven’t talked with anybody, yet, that’s had that amount dispersed. It’s possible that they contact you in three days in order to get your banking information to then disperse it, so we’ll keep you updated as we learn more. That $10,000 advance is a big deal because even if you were declined for EIDL, you are still going to get approved for the advance.

Q: What is the application process?

A: The new application process for EIDL is great. It’s a huge improvement. I’ve heard of people applying in as little as five minutes if they have all of their paperwork put together. The website says it could take up to 2.5 hours. The website is being generous. It’s a very simple loan so long as you know your budget, you know your expenses, and your revenues.

Q: Virtually everyone who applies will get the advance, then?

A: So long as you are a business or nonprofit with under 500 employees and you meet all of the requirements that they list on the first page of the application.

Q: If I am approved for an EIDL, is this $10,000 advance taken off of the loan?

A: The amount of the EIDL advance only comes into consideration when we start talking about the Paycheck Protection Program. It’s possible that the SBA will say because you got this advance you need $10,000 less for the EIDL, but they’re continuing to look at the macro picture of the business as far as the total amount of operating expenses that need to get covered.

Q: What business information should I expect to need to apply?

A: Businesses submit their financial information, their revenues, their budgets for the previous year, personal identification for any owners over 20% and you need to be able to explain the impact of COVID-19 on your business so that you don’t make the SBA guess. Help them understand how they need to calculate the impact so you get the right loan amount the first time.

Q: How long will it be before I am able to get the money?

A: The (SBA) should come back with that loan offer, which the company can then accept or decline. It’s expected to take another five days after that offer to get disbursed for a total time span of probably at least one month from the time of application. But, it’s over applied right now, so companies may see a longer timeframe than one month.

Personal Protective Program (PPP):

Q: How does the Paycheck Protection Program differ from the Economic Disaster Relief Loan?

A: The Paycheck Protection Program is very similar. They’re both targeting operating expenses. The difference between the two is that the Paycheck Protection Program is really targeting payroll costs. The logic behind this is to try and keep businesses open. But as businesses look at their operating expenses, the easiest thing to cut is payroll. You have a lot of obligations that you can’t easily get out of, but you can lay off your employees. What the Paycheck Protection Program does is say, “We will subsidize you keeping your employees in place so that they don’t have to get laid off; so that they don’t file for unemployment.”

The maximum amount the loan can be is (average monthly payroll costs x 2.5). On the back end, the government will forgive up to 8 weeks of payroll costs plus some additional things such as rent, interest on mortgage obligations and utilities. So, that’s going to include your gas, water and internet. This is huge because, essentially, that makes 8 weeks free to keep your employees in place.

Q: When can I apply?

A: Starting April 3, 2020, small businesses and sole proprietorships can apply for and receive loans to cover their payroll and other certain expenses through existing SBA lenders. Starting April 10, 2020, independent contractors and self-employed individuals can apply for and receive loans to cover their payroll and other certain expenses through existing SBA lenders.

Q: Do I have to pay back the loan?

A: The biggest benefit is the government is trying to subsidize 8 weeks of payroll costs for employers. The number of full time employees for this period, as compared to 2019 will be taken into account. If a company employs 10% less full time employees, they will receive 10% less forgiveness for their PPP loan. If a company reduces any employee’s wage who makes under $100,000 by 25% or more, the amount of their forgiveness will be reduced by the amount that they reduced that employee’s wages.

Q: Why is PPP a better option than having people file for unemployment?

A: For most employees, they will receive more money receiving their salary than they will for unemployment benefits even though the CAREs act [increased] unemployment benefits by about $600. That’s still only up to $2,000. A lot of people will make more than that receiving their paycheck. This also keeps employees in place. Rather than being laid off and having to worry about when their employer will bring them back or what job comes next, this allows them to continue being paid by the same employer, receiving benefits from the same employer; it creates continuity during a crisis.

Q: Will everyone who applies be approved?

A: We’re concerned that not all businesses who apply will get covered. If the government runs out of money before they’re able to give loans to all of the businesses, some people might get left out. Our strong recommendation is to do this as quickly as you can.

Q: How many employees will it cover?

A: Payroll costs are capped at $100,000 per employee.

Q: Hypothetical: I’m a business who already laid off my employees. Can I qualify for the Paycheck Protection Loan?

A: You can bring those employees back. So long as you have them employed for the 8-week covered period, you should be able to qualify to have their payroll costs forgiven. The payroll costs are capped at $100,000 per employee.

Q: What is the application process like for this program?

A: It’s still a work in progress. We’ve seen some templates, which look relatively straight forward. But, while the application is relatively straight forward, the supporting documentation will be a little bit more complicated because companies will need to document all of their eligible payroll costs. That’s going to be salary and benefits. It’s going to be payroll taxes. It’s going to be all of that information in order to demonstrate the payroll costs for 2019.

Q: Whats the difference in the amount of funds available compared to the EIDL?

A: The PPP has a higher maximum amount, so it’s (average monthly payroll costs x 2.5) up to $10 million, whereas the EIDL is up to $2 million. That being said, from a practical point of view, this is a narrower slice of operating expenses, whereas EIDL says it will cover all operating expenses. PPP is just for the payroll costs portion of it, so functionally for most businesses that will be smaller.

The other piece here is to think about timeframe. EIDL is only constrained by the observed impact of COVID-19, PPP is for an 8-week period from the disbursement of the loan.

Q: How long will it be before I get my money?

A: We’re still figuring that out. It’s an SBA program, but will be administered by banks. These are the CT banks approved by the SBA to handle these loans:

I ATTACHED THE BANKS IN A PDF.

Banks are working quickly to figure out the process but we don’t have a timeline right now. Hopefully PPP will be quicker because we’re able to leverage the logistics and infrastructure of the private banks.

OTHER:

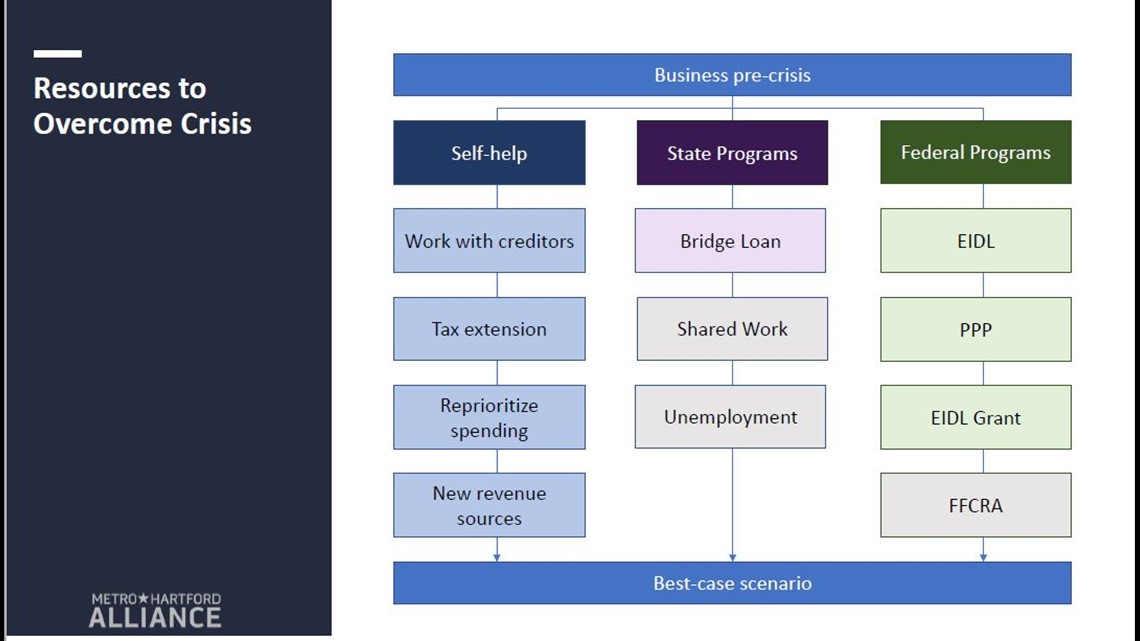

Q: Can I apply for both the EIDL and PPP?

A: Apply for all of the loans. None of the loans require you accept them. In this situation of uncertainty, it doesn’t hurt to have options. All of these loans are made to work together. They also work with the CT Recovery Bridge Loan. Nothing disqualifies you from being able to accept the other. It’s important to make sure to carve out 8 weeks of payroll expenses for PPP so that you don’t duplicate your usage with the EIDL, but they all work and businesses need as much help as they can get.

A very important thing for companies is you cannot use both loans for the same thing. It will be very important to carve out that 8 weeks of payroll costs that you will use the PPP for and then you will apply for forgiveness to get reimbursed for those expenses—carve that out so that you use the PPP for that and then for every other operating expense, you use EIDL.

Q: What do I do, as a business owner, to try to keep my doors open while I am waiting for the money? The EIDL Advance is one way. What are others?

A: Businesses can talk with their creditors, try to get deferments, forbearances, try to reschedule payments. Reach out to your landlord. Reach out to your credit card company. Reach out to your bank. These organizations are trying to be very flexible. They can also reprioritize payments. There are things like utility bills and taxes that have been delayed or where those companies aren’t allowed to evict a business. The last piece is look for creative sources of revenue. A lot of restaurants have done a great job using delivery and takeout more than they did in the past. I’ve heard about the seafood market actually selling direct rather than trying to go through stores.

HARTFORD METRO ALLIANCE WEBINAR:

Q: What is the webinar hosted by the Metro Hartford Alliance tomorrow?

A: It’s an open-ended invitation to anyone. Click here for the invitation.

The goal is to take a practical look about how to go step-by-step through the application, gather the requirements that your bank will need. We don’t make a guarantee that we know exactly what your bank will ask for, but the goal here is to help people do their homework so the process moves faster. We’re concerned that not all businesses who apply will get covered. If the government runs out of money before they’re able to give loans to all of the businesses, some people might get left out. Our strong recommendation is to do this as quickly as you can.