HARTFORD, Conn. — Update May 7, 2020: The Red PUA button is now available on the DOL website. See instructions below.

The COVID-19 pandemic has caused hundreds of thousands of people in Connecticut to lose their jobs, or lose work-hours; and that includes the self-employed.

April 30, The Connecticut Department of Labor announced it will begin accepting claim applications for the self-employed.

Many self-employed indivuduals are eligigle for unemployment benefits under the Federal Pandemic Unemployment Assistance program.

"Our agency is proud of the work it has accomplished in order to serve the self-employed – individuals who have not been eligible to apply for unemployment benefits in the past, but are now facing workplace situations never seen prior to the COVID-19 pandemic," said State Labor Commissioner Kurt Westby.

"The new online ReEmployCT system meets mandated integrity requirements while providing a federally-required two-step application process," Westby said.

Self-employed or "gig" workers should file through Connecticut's unemployment system at filectui.com.

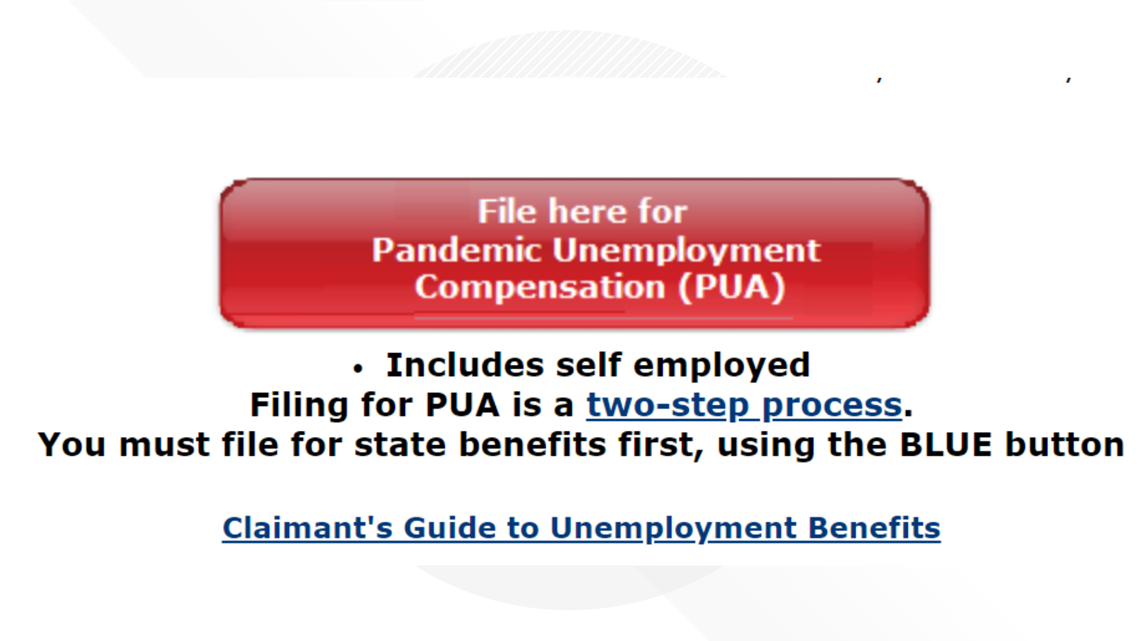

The CT DOL outlines a two-step process for the self-employed.

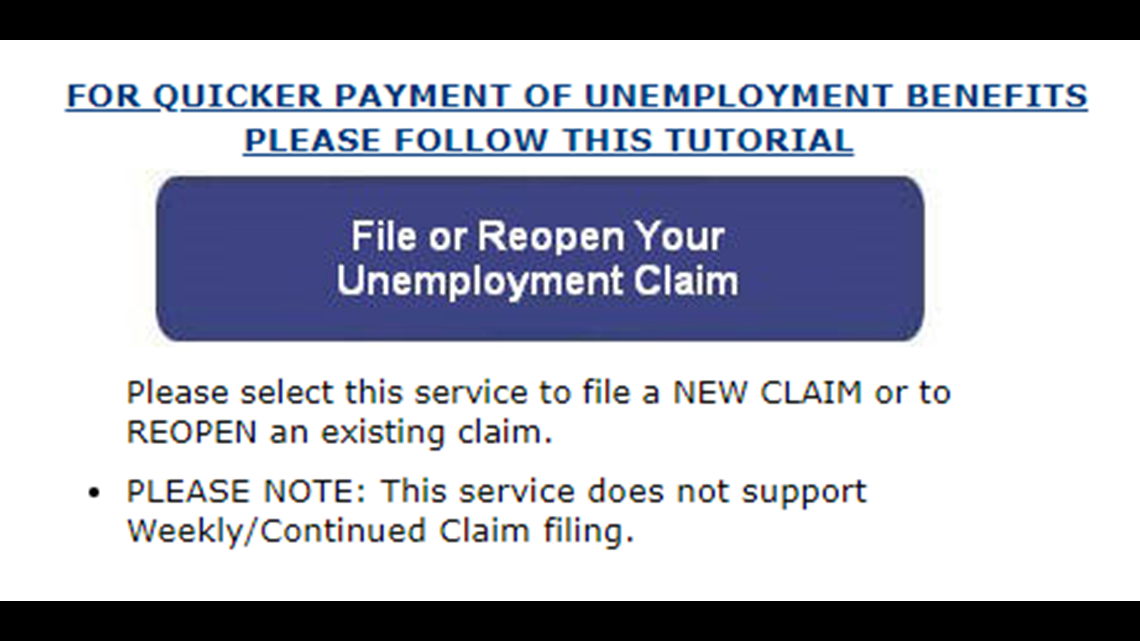

Step 1: File a regular state claim at filectui.com and click on the blue button to file. Self-employed individuals who have already file an application through this system should not file again. The DOL already has claims and is asking you not to file a duplicate claim.

After filing, you should receive the following email (check your spam folder as well):

“Thank you for submitting your online application for unemployment compensation benefits with the Connecticut Department of Labor. … Please look for a CONFIRMATION EMAIL notifying you that your claim has been processed. This email will include your NEXT STEPS information including instructions for when to start filing your weekly claims."

Expect a second email from the CT DOL that says: “Your claim for benefits has been processed! If this is a new claim then we are sending information regarding your claim via US mail.”

Now it's time to wait for your mail. The Department of Labor will send you a UC-58.

Step 2: Go back to filectui.com and click on the "PUA button".

Through that red button you will be able to fill out the Federal Pandemic Unemployment Assistance program application.

Applicants will need:

- 2019 IRS forms

- 1099

- 2019 W-2s

- Schedule C.

- earnings for 2019, broken down by quarters.

Those without tax records for 2019 can self-attest their earnings, but will be subject to audit. Applicants will be asked the date when COVID-19 impacted their employment. Federal guidelines allow this to go back to February 2, 2020.