HARTFORD, Conn. — Most economists feel that a recession is coming, and with recessions comes market downturns, which can lead to some very scary 401k balance statements.

So, should you make your investments more conservative to limit your losses?

Chartered Financial Consultant John Caserta said that if you do, you’ll likely lose more in the long run than you’ll lose now.

“Studies have shown that short-term changes are one of the leading causes why investors lag overall markets when it comes to return, so those short-term changes can be very detrimental,” said Caserta.

Here’s something else you need to know:

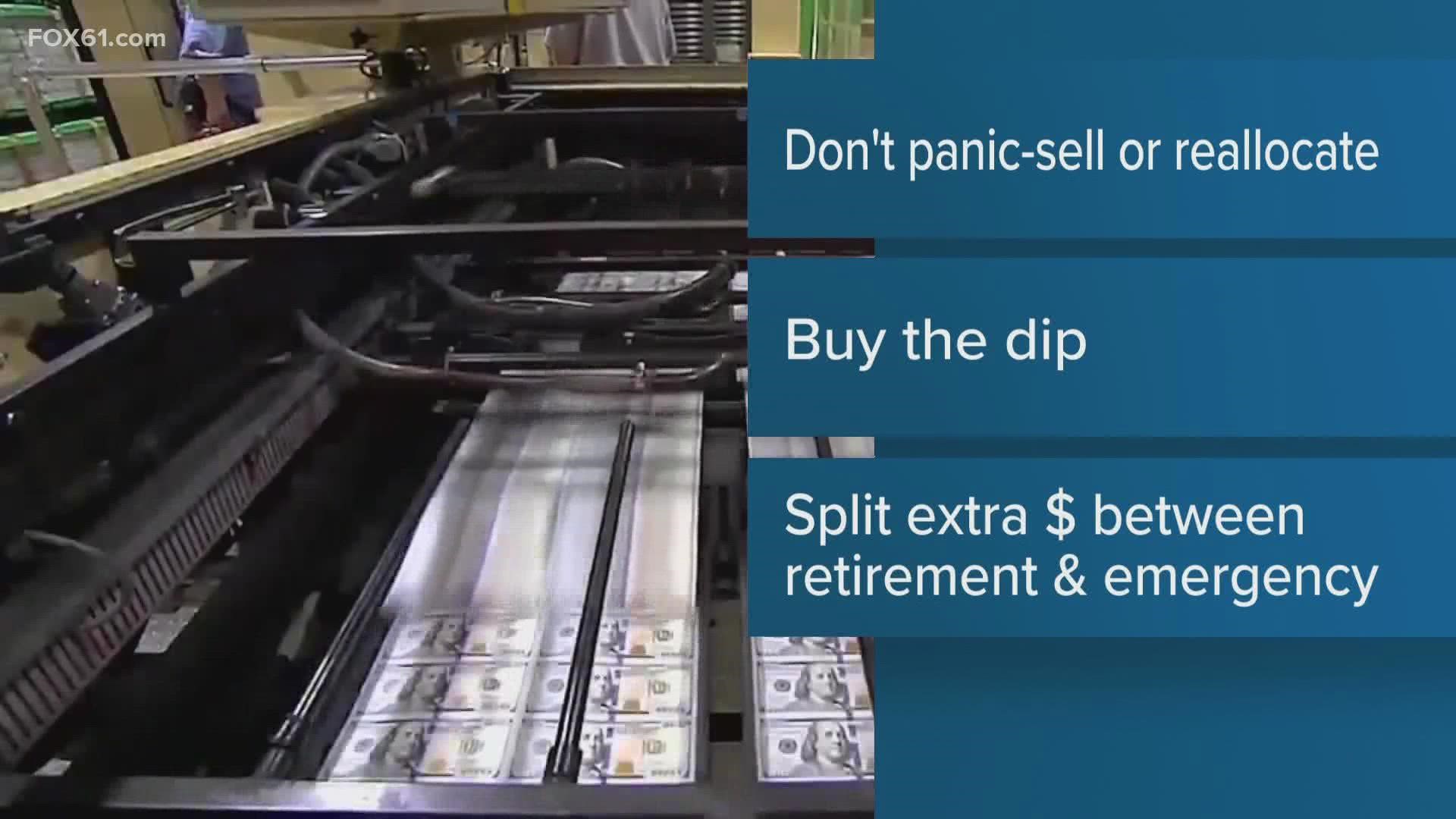

Do NOT panic sell or reallocate.

There’s an old saying about investing - time in the market beats timing the market. In other words, you can’t risk missing out on the good days to miss a few bad ones.

“Studies have shown even if you miss a few of the best days in the market over a long period of time, that could really hurt your returns in the long run,” said Caserta, “and the problem is we just don't know when these best days are going to occur.”

...but DO buy the dip

While you shouldn’t time the market, don’t be afraid of putting extra money in if the market has dropped significantly.

It’s a matter of perspective – don’t look at it as trying to time the market so much as entering it earlier than you would have.

Put it differently, you’re adding to that time in the market.

“[A market decline] would be a great opportunity to enter the market, especially if you have time on your side,” said Caserta, “For young people just starting out, this is a great time.”

Split extra money between emergency and retirement funds

Many people, especially younger workers, don’t have much money to enter the market, especially lately, so it can make for a tough choice: Lock away money toward retirement or keep it close by in an emergency fund?

Caserta said it depends mostly on what you’ve been doing.

“I would say a little bit of both, and it depends on your situation,” said Caserta, “if you've spent some time in the market, just investing, and you've had a great run up, but you've ignored those, that emergency savings, it might be worthwhile to dial up that emergency savings, and the same thing goes, vice versa.”

---

Tim Lammers is an anchor at FOX61 News. He can be reached at Tlammers@fox61.com. Follow him on Facebook, Twitter, and Instagram.

Have a story idea or something on your mind you want to share? We want to hear from you! Email us at newstips@fox61.com

HERE ARE MORE WAYS TO GET FOX61 NEWS

Download the FOX61 News APP

iTunes: Click here to download

Google Play: Click here to download

Stream Live on ROKU: Add the channel from the ROKU store or by searching FOX61.

Steam Live on FIRE TV: Search ‘FOX61’ and click ‘Get’ to download.