HARTFORD, Conn. — There's been a lot of attention lately on high-risk, high-reward investments, like Bitcoin and meme stocks, while low-risk investments like Treasury Bills and Bonds don't get a lot of love.

Lately, though, they've been having a bit of a moment, and depending on your finances, this could be a great opportunity to take advantage.

“There's a better alternative than keeping your money in the bank or under the mattress,“ said Paul Schatz, the president and founder of Heritage Capital, LLC.

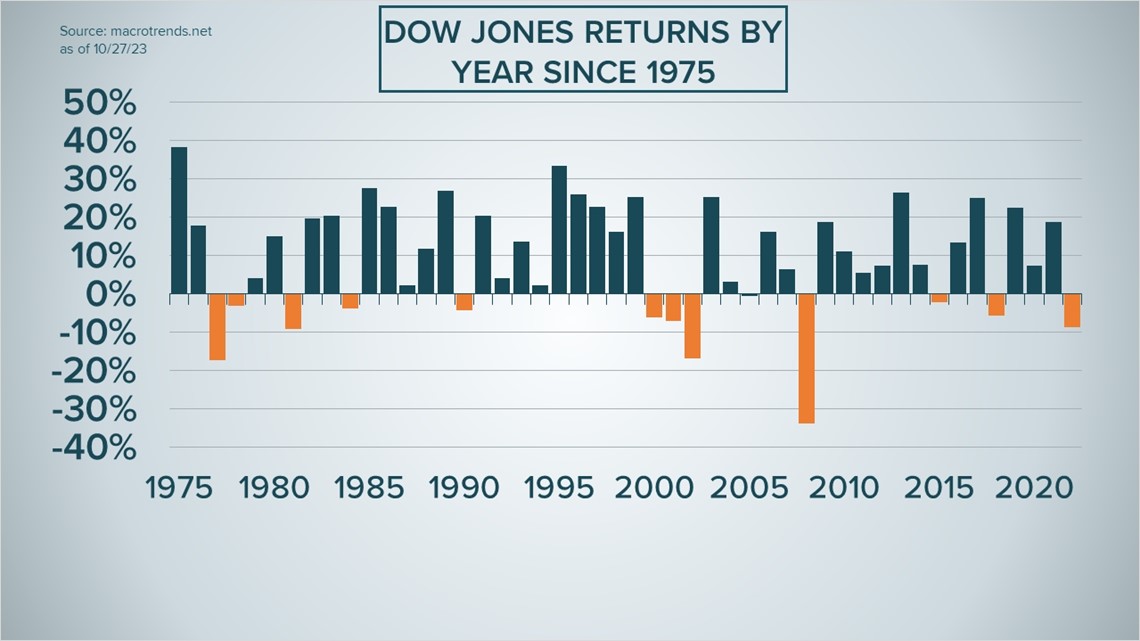

Now, to be clear, for those who can afford to do long-term investing, Schatz said the stock market is still the gold standard, assuming they invest wisely.

“The stock market has been the single best-performing asset over the long term,” Schatz said. “Depending upon which index you choose, the Dow or the S&P 500, you're going get between eight and nine percent [for a yearly profit], including dividends.”

However, it’s important to remember that an 8-9% return is a historical yearly average. It is not a guarantee of future performance.

Indeed, looking at the yearly returns of the Dow Jones Industrial Average, there were many years, like in the late 1990s, when it was returning between 20-30% a year for multiple successive years. On the other hand, in 2008, it lost roughly 30%, which could be a big blow to people with not a lot to invest, or people who were hoping to withdraw that money in the near future.

That’s why it’s important to keep your money in the stock market for a long time, to even out those swings.

“[Otherwise] you don't get that really smooth, really easy to accept, non-panicky path,” Schatz said.

Enter Treasury Bills, or T-Bills, as they’re called. They differ from stocks in many ways. First is that they’re as stable as the stock market is volatile. T-Bills are loans that you give the government, which the government pays back to you at a set interest rate. By definition, they are loans that last anywhere from four weeks to one year.

“They're guaranteed by the full faith and credit of the us government,” Schatz said. “It is the single safest investment on the face of the earth.”

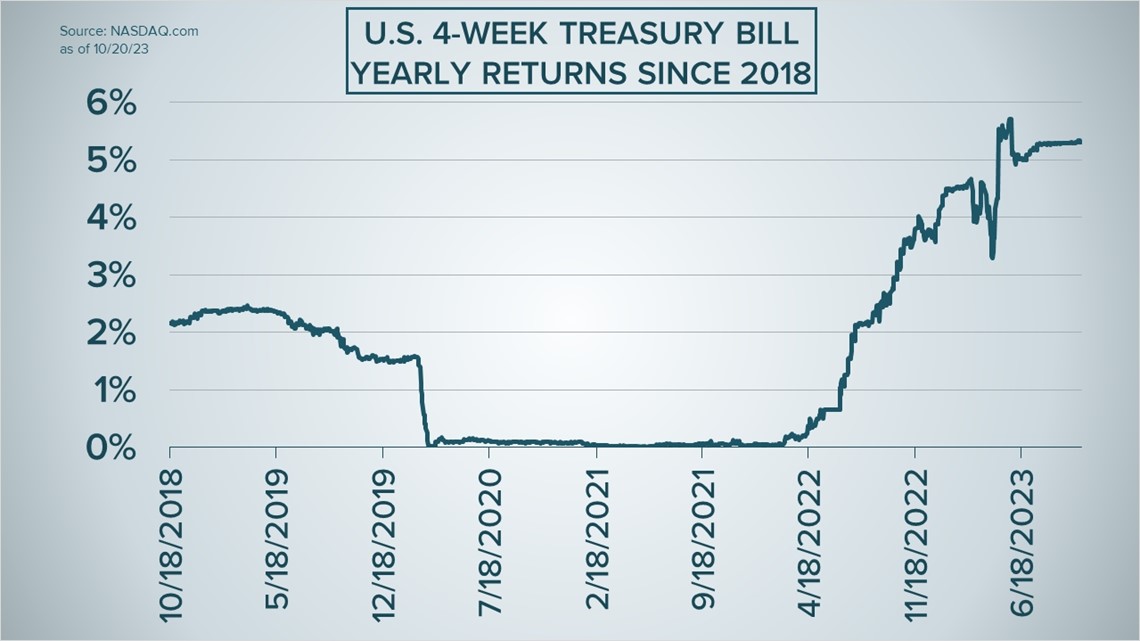

Historically, that safety has come at the expense of profitability. As recently as two years ago, the yearly return for T-Bills was effectively zero. It was so low that a $10,000 T-Bill would have paid out $1 in profit over a full year.

However, things changed once the Federal Reserve started raising interest rates to slow inflation. For the same reason that it costs more to take out a loan for a car or house right now, it also costs the government more in interest to take out a loan from YOU. That interest rate that was near zero two years ago is currently well over 5%.

“It is the most meteoric epic, historic parabolic rise on a percentage basis in history, we've never had rates go up on this trajectory in history,” Schatz said.

This means the profit on a $10,000 investment has grown from $1 per year to over $500 per year. It has made a boring investment suddenly both attractive and stable, simultaneously. Granted, it still isn’t approaching that 8-9% expected return from the stock market, but the guaranteed profits, and the flexibility of only committing your money for as little as four weeks, might make for an attractive investment.

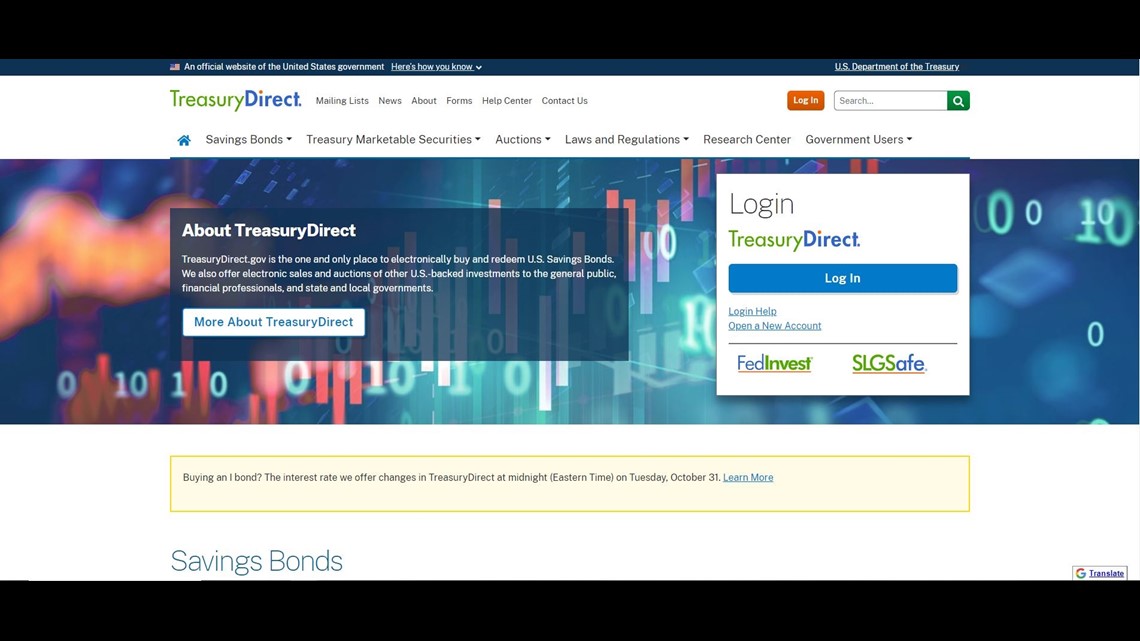

In addition to all that, you can do buy T-Bils yourself, in minutes, from the comfort of your own home, without any additional fees or commission. It can be done online – it has to be done online. All T-Bills are bought electronically through one, and only one website – treasurydirect.gov.

Interested in investing through treasurydirect.gov? Here’s a basic guide on how to do that:

- Log onto treasurydirect.gov and click on “Open a New Account.” There will be a multi-step process to verify you and your account, and there is multi-step authentication each time you log on, but considering you will be trusting a government website with your financial information, this is not a bad thing.

- You will most likely link that account to a bank account, so you will need your account number and the routing number for your bank. Both of those can most easily be found at the bottom of one of your checks.

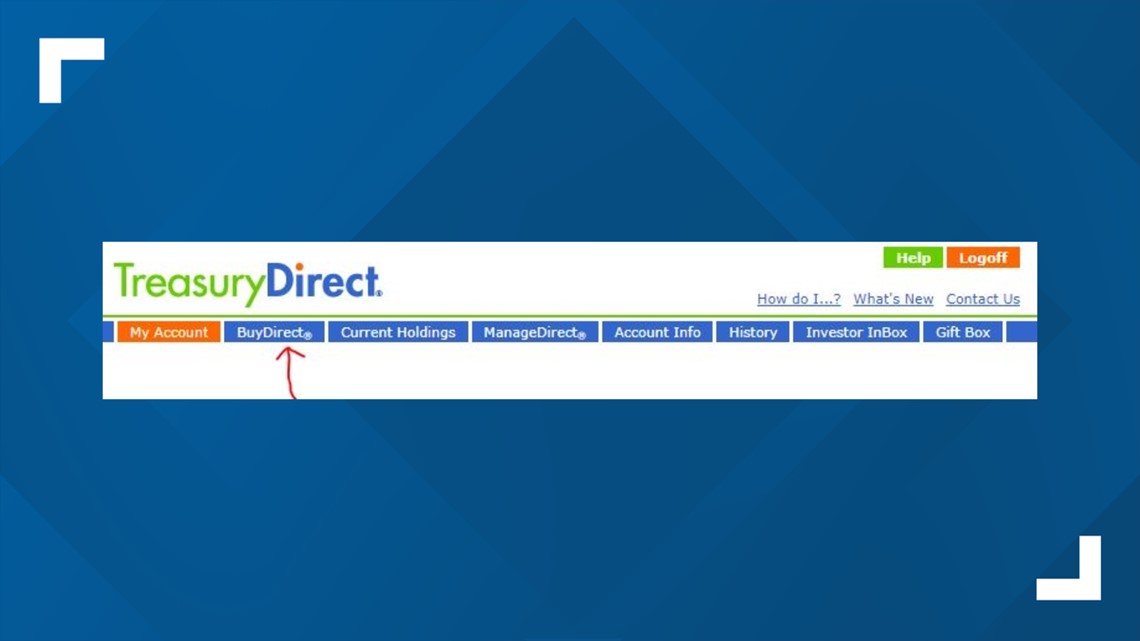

- After your account is confirmed and you’re logged in, go to the home page and click on BuyDirect on the top menu bar.

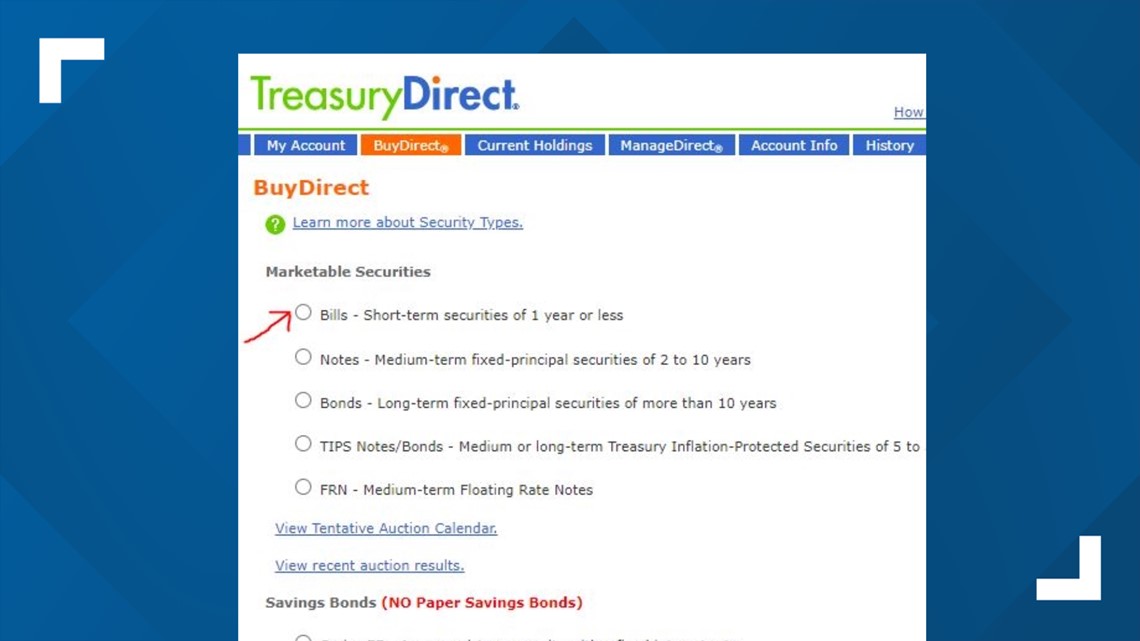

- On the following page, look for Marketable Securities. You have several options here, including buying Treasury Notes and Treasury Bonds. Those both work on the same principle as Treasury Bills but are investments with maturity dates between 1 and 30 years. We’re focusing just on Treasury Bills, so select “Bills” and click Submit.

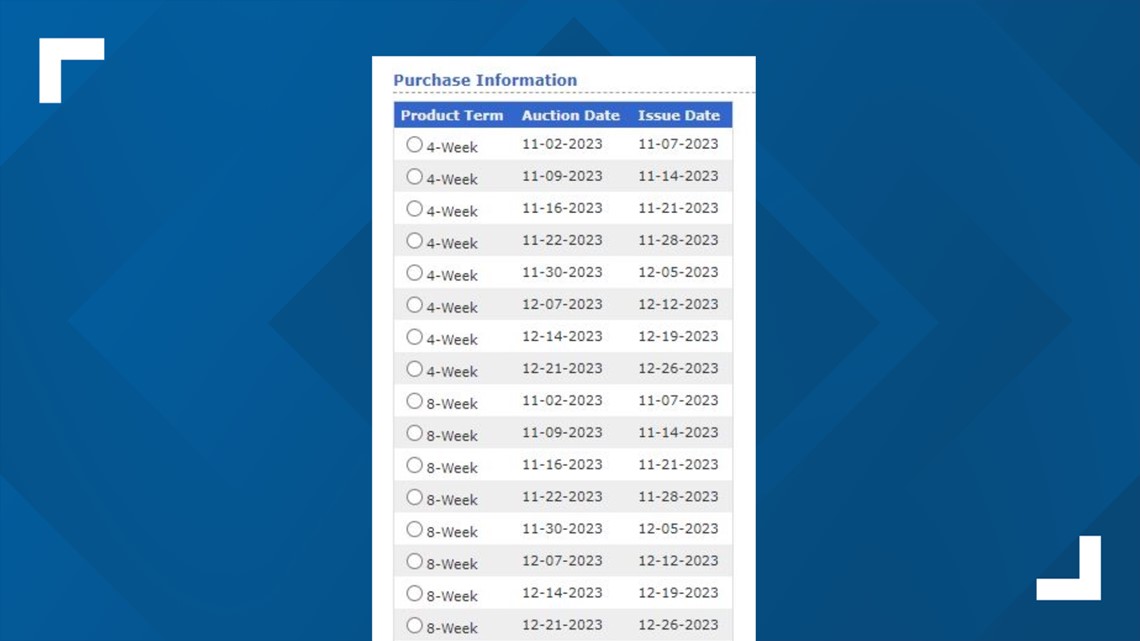

- You should now be on a webpage that says Purchase Information, with the option to choose Treasury Bills that mature at different times – from as little as four weeks to as many as 52 weeks. You will also see several auction dates and issue dates for each term length.

- Don’t worry about the auction date – you won’t be the one placing any bids. Instead, when you agree to buy a T-Bill, you are pooling your money with many other people and institutions to collectively auction the interest rate you’ll get. So, to be clear, you won't know the exact interest rate you’ll be getting, but Schatz said the rates only vary by small amounts, and you have a way to get a good idea. “All you have to do is look on the Treasury's website for results of past auctions,” Schatz said. Also, T-Bills of all term lengths are currently getting over 5% per year. Choose a term length, and at which date you want your bill to be issued.

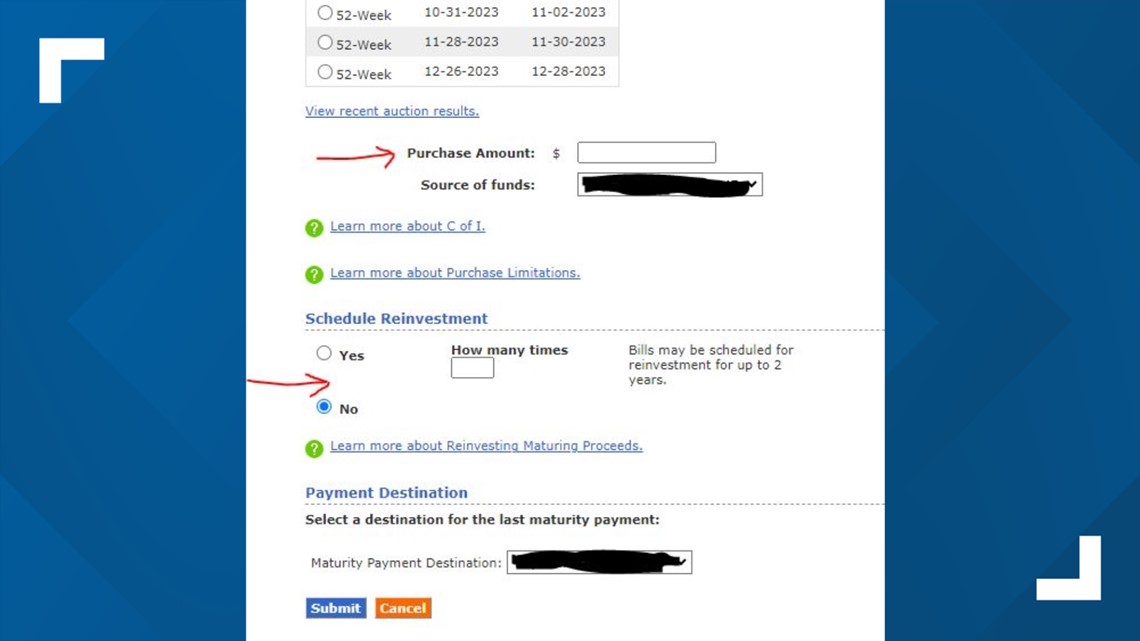

- Next, scroll down to the bottom of the screen and choose how much money to invest. The minimum amount is $100. The maximum amount is $10 million. However, the amount you choose is NOT the amount you’ll be spending.

You might think that, for a $100 T-Bill, you spend $100 and then get that amount plus the profit when the bill matures. Schatz said it’s the other way around.

“You're going to buy them at a discount, and then mature at face value. In other words, you buy a $100 treasury bill at $99. They give you back $100,” Schatz said.

Keep in mind that, while every term is currently yielding over 5% per year, that’s per year. A four-week T-Bill will return 1/13th as much because it’s 1/13th the length of a full-year (52-week) T-Bill.

Once you’ve committed to a dollar amount and a length, you can then choose to automatically re-invest the money a certain number of times. Schatz said, that in the case of a $100 T-Bill that has matured, your reinvestment would once again be a $100 T-Bill that you’re buying (again) at a discount, and getting back $100 when it’s done.

- Next, choose the destination for your matured money – this will almost always be the same bank account that the funds came out of, but you can choose a different destination.

- Finally, click submit, and that’s it! Everything else will be taken care of, and soon you will have your own Treasury Bill.

RELATED: Powell at Jackson Hole: Economy's solid growth could require additional Fed hikes to fight inflation

There are two more things to keep in mind.

One, while these are short-term investments, you can re-sell them on a secondary market at any time, should there be an emergency and you need the money (although it is generally not advisable to invest emergency funds in a way that could make them hard to access).

The last thing to know is that this opportunity will not last forever. Eventually, these interest rates will come back down to earth, most likely after the Federal Reserve brings its key interest rate back down to historically normal levels.

Tim Lammers is an anchor at FOX61 News. He can be reached at Tlammers@fox61.com. Follow him on Facebook, X, and Instagram.

---

Do you have a story idea or something on your mind you want to share? We want to hear from you! Email us at newstips@fox61.com

---

HERE ARE MORE WAYS TO GET FOX61 NEWS

Download the FOX61 News APP

iTunes: Click here to download

Google Play: Click here to download

Stream Live on ROKU: Add the channel from the ROKU store or by searching FOX61.

Steam Live on FIRE TV: Search ‘FOX61’ and click ‘Get’ to download.