HARTFORD, Conn. — Governor Ned Lamont said the 2.2 trillion-dollar federal Coronavirus Relief Bill on top of small business loans should be enough to get Connecticut back on track.

It is a bill that would provide close to 1.2 million dollars for each state.

"This is a virus that knows no borders!" said Lamont.

Lamont said he has been listening to the flood of calls dialed into the 211 hotline. Many people are worried about their small businesses and being unemployed.

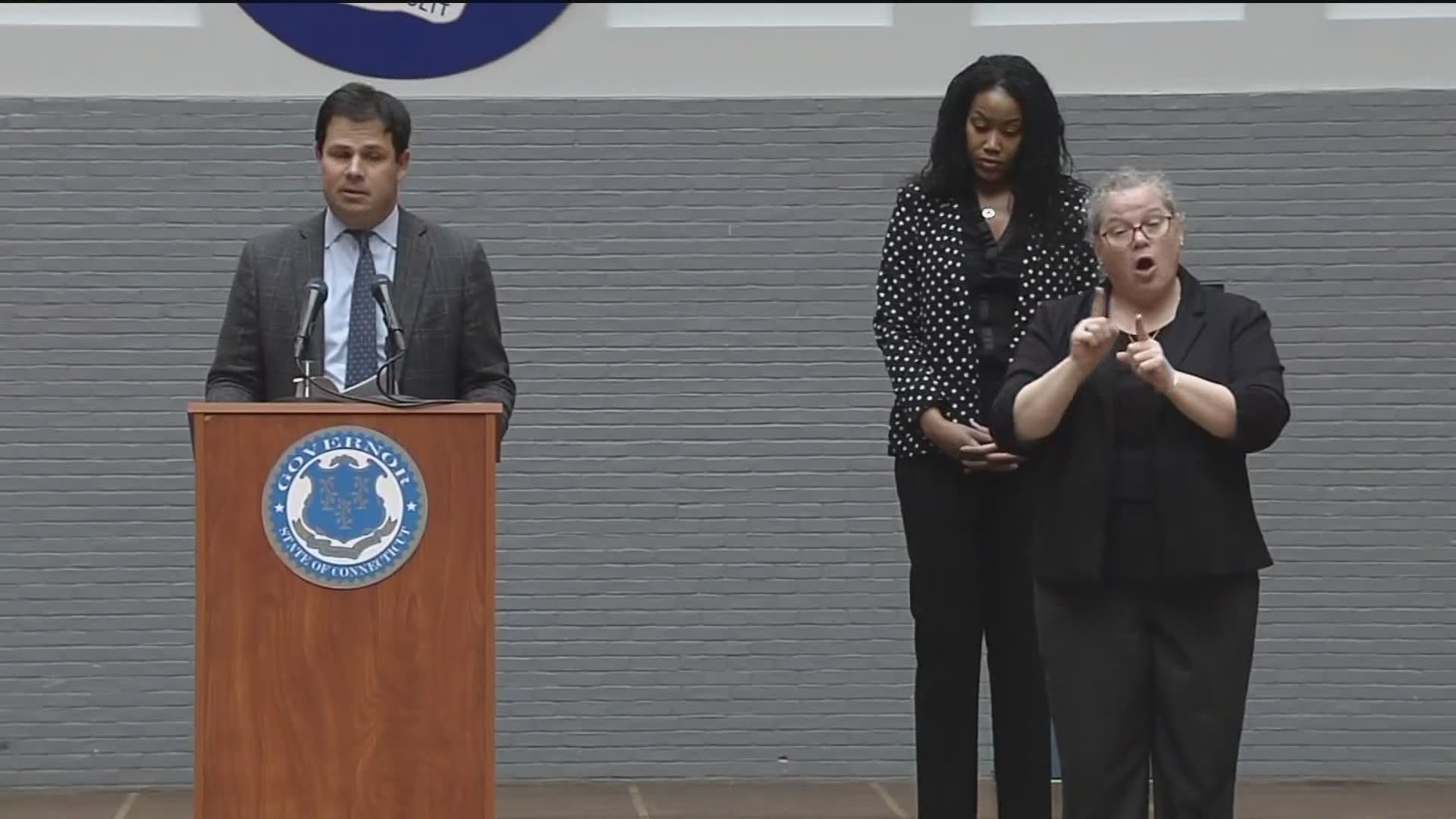

Economic and Community Development Commissioner David Lehman said there are options for small businesses through two types of loans.

- Connecticut Bridge Recovery Program

- Businesses up to 100 employees

- Offer 0-percent - no interest on an 18-month term

- Loan amount capped at 75-thousand dollars

2. Paycheck Protection Program

- Businesses up to 500 employees

- 8-week compliance period - if a business maintains its payroll retroactive to February 15th, the loan will become a grant

- Sized at 250-percent of one's monthly payroll to provide two months of payroll plus incremental dollars

"The size of these loans if you use the governor's one-percent, this is 3 and a half potentially more billion dollars that will ultimately become a grant to benefit Connecticut's small businesses," said Economic and Community Development Commissioner David Lehman.

Also talked about was personal protective equipment. Lamont said a new order of face masks and other equipment, including ventilators, have been ordered and should arrive in two days.

"There are ambulatory care surgical centers that have no longer a need for the ventilators that they use at least right now and they've been donated to the state," said Department of Public Health State Epidemiologist Dr. Matthew Cartter.

Any small business that is interested in applying for one of the loans can start to apply tomorrow morning.