HARTFORD, Conn — Lisa wrote the following email to FOX61:

“I was at Ocean State Job lot in Berlin today picking up some items and saw a sign that read they were adding a 2% increase to all products. This is an increase Ocean State is passing onto their customers for a recent $2 raise they gave their employees. The sign also reads at the bottom that you can tell the clerk you don't want to participate in this increase as it's optional.

I opted out, but had to tell the clerk this as I was not asked in the beginning of my sale being rung up. I had 2 PT jobs at the beginning of March, but lost one of them since Covid-19 shut down. I am not collecting so I don't have that extra $600 a week from unemployment coming in either. I feel that if Ocean State wants to give their employees a raise that's certainly commendable, but why should I, the consumer, have to foot their raise when I'm already supporting the business with my purchases?

And then I’m charged extra sales tax because this is not rung up as a separate item.

The clerk had to get the manager to figure out how much money I was owed back since this was already included on every product. If this is an optional increase should it not be rung up differently?

Is this legal and or is this also price gouging? The company claims it’s for the employee but if it's tacked onto every product how does this not go towards their profit as well?”

Answer:

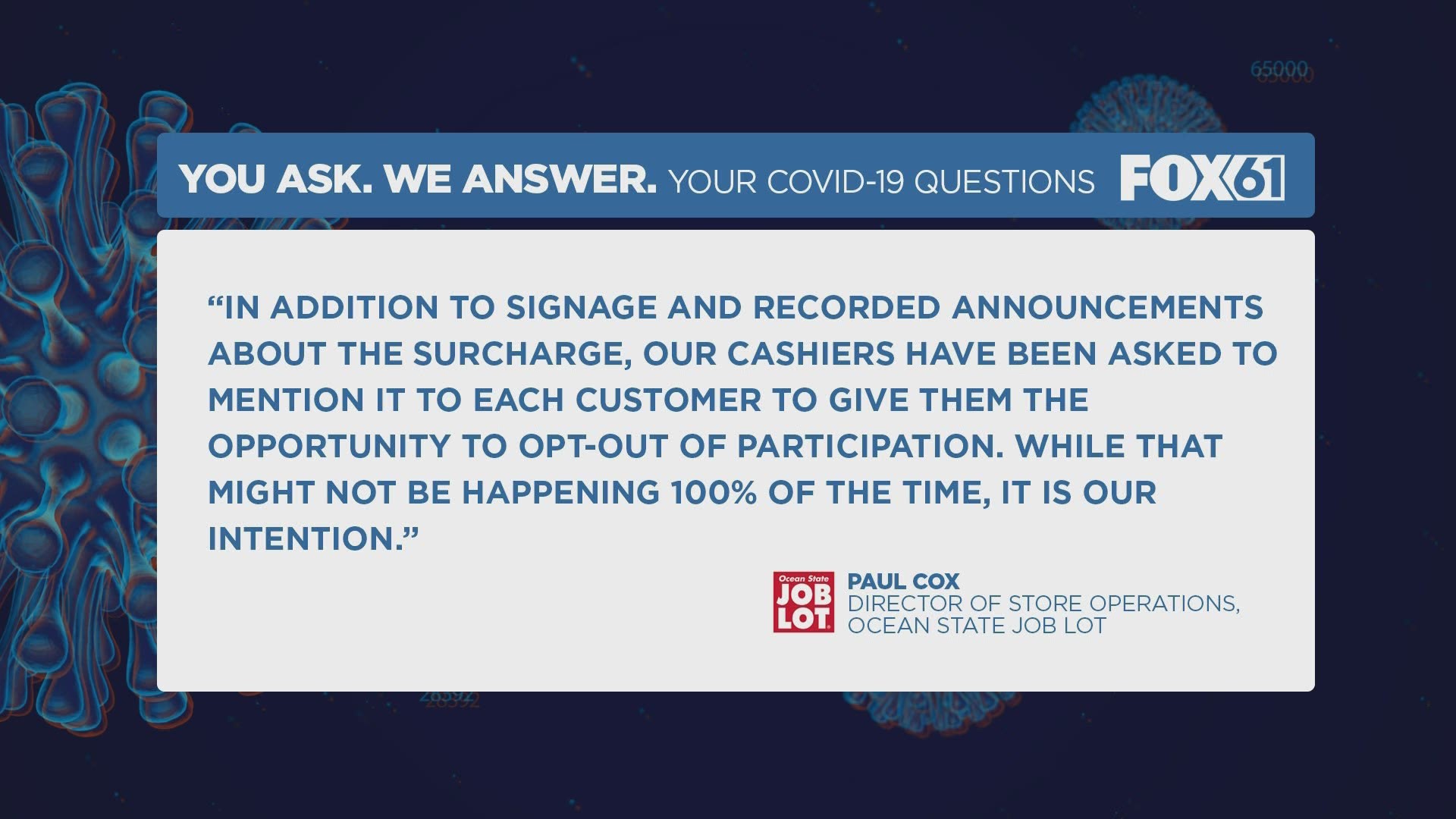

FOX61 reached out to Ocean State Job Lot and received this statement from Paul Cox, Director of Store Operations:

“The 2% surcharge is an optional contribution from customers to our associates, in addition to a company-funded $2 per hour worked bonus and a 30% associate shopping discount. The surcharge gives our customers the opportunity to show their support for our dedicated team members. In addition to signage and recorded announcements about the surcharge, our cashiers have been asked to mention it to each customer to give them the opportunity to opt-out of participation. While that might not be happening 100% of the time, it is our intention. We appreciate our generous customers who choose to participate, and we respect those who choose not to participate at this time. Customers with questions or concerns may contact Ocean State Job Lot’s Customer Service team at 401-295-2672."

FOX61 was told that managers do have to be involved if the purchase was rung up incorrectly.

FOX61 also reached out to the State of Connecticut to see if this action was legal.

The Department of Revenue Services said, a retailer can add a two percent mark-up (or any other amount it chooses) to products it sells. It said assuming the products purchased are not specifically exempted in statute, sales tax would apply to the total sale, additional mark-up included. However, a retailer does need to be clear on the terminology, because a retailer can’t assign additional sales tax to an item. That is up to the Legislature to make any changes in state sales tax.

RELATED: You Ask. We Answer | Spas reopening