HARTFORD, Conn. — Stocks stabilized after a three-day plunge sent traders and consumers into a frenzy, building up fears of a recession.

The Dow Jones Industrial average fell more than 1000 points. The S&P 500 tumbled down 160 points on Monday, marking the largest one-day drop in nearly two years.

David Sacco, a lecturer of finance and economic at the University of New Haven, said, “It’s human nature to act emotionally about it, but when you invest you kind of have to try to take the emotion out of it.”

That’s a tough feat for those battling already high inflation and rising cost of living prices. The economic turmoil has been fueled by a slowdown in both hiring and spending, as laid out in the most recent jobs report.

“The market is always based on the market prices rather are based on how investors feel about the state of the economy, the political situation, what’s going on in the federal reserve and the global economy and we’re sort of at one of those points where there’s a lot of flux in all of those things,” said Sacco.

Though stocks have stabilized for now, there is still some concern over high interest rates. Economists predict that the Federal Reserve will cut rates next month. Sacco said the fed has the challenge of balancing inflation levels with interest rates.

“Think of the analogy of the economy being a car barreling down the highway,” explained Sacco. “When it’s going 85 in a 55, that’s too fast, you risk an accident. If you jam on the brakes that’s also problematic. So you’re trying to kind of slow things down to a pretty good rate of growth, but one that’s not going to cause any problems.”

For everyday consumers juggling elevated prices on just about everything, Sacco said to hold tight when it comes to investments, only putting money into the stock market that is needed to financially rely on in the short-term.

“We need these periods of volatility because that tells you the market is kind of doing its job in terms of evaluating risk. If you basically are passively investing you can pretty much guarantee that as long as you hold the money in the market for ten years, you’re going to average a return of ten or eleven percent,” said Sacco.

Even including this recent slide, U.S. stocks remain in ‘positive territory’ this year, with the S & P 500 gaining around 9.4% and the DOW up over 2.5%.

RELATED:

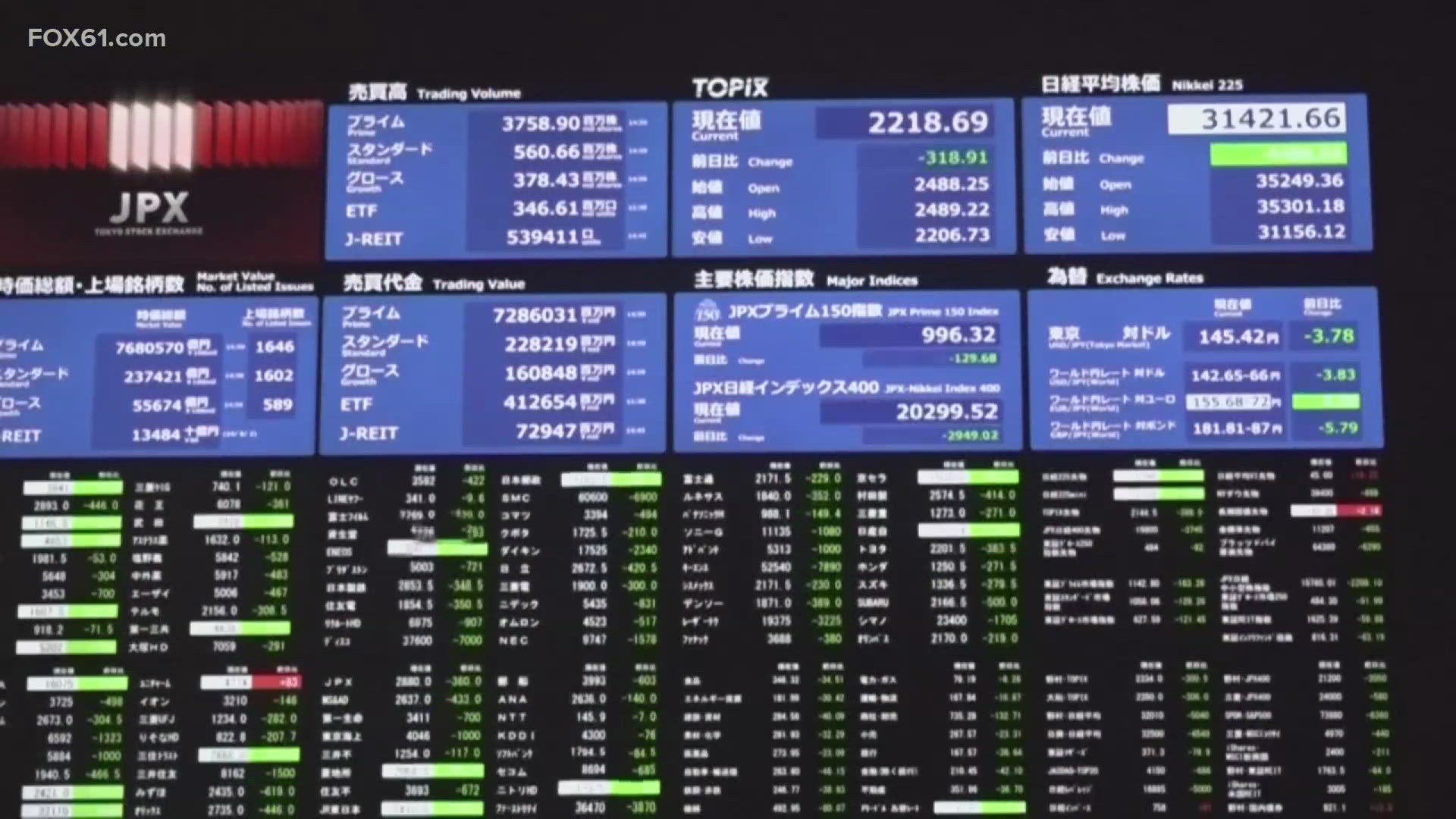

Dow drops 1,000 points, and Japanese stocks suffer worst crash since 1987 as markets quake worldwide

---

Do you have a story idea or something on your mind you want to share? We want to hear from you! Email us at newstips@fox61.com.

HERE ARE MORE WAYS TO GET FOX61 NEWS

Download the FOX61 News APP

iTunes: Click here to download

Google Play: Click here to download

Stream Live on ROKU: Add the channel from the ROKU store or by searching FOX61.

Stream Live on FIRE TV: Search ‘FOX61’ and click ‘Get’ to download.