NEW BRITAIN, Conn. — A Connecticut tax preparer and his businesses were issued a permanent injunction May 21, preventing them from preparing federal tax returns for other people, according to the U.S. Department of Justice.

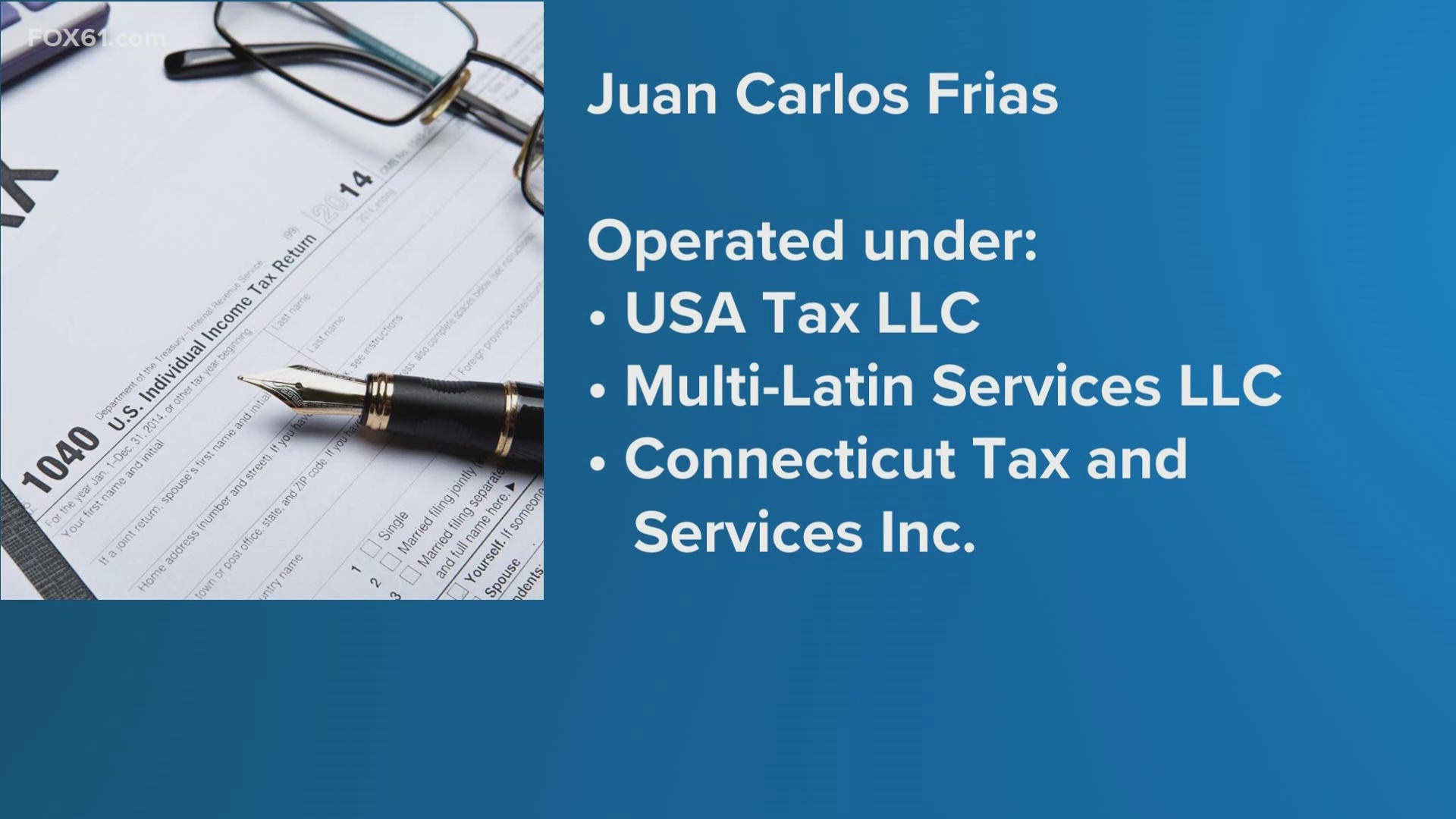

As a result of the injunction issued to Juan Carlos Frias, his three businesses, USA Tax LLC, Multi Latin Services LLC, and Connecticut Tax and Services Inc., have been shut down. State business records show USA Tax and Multi Latin Services registered in New Britain; the Secretary of the State's office does not have a listing for Connecticut Tax and Services under Frias' name.

According to the DOJ, the companies prepared over 10,000 tax returns for their customers between 2017-2021.

A complaint from the DOJ alleges that Frias and his businesses "understated customers' liabilities and inflated their refunds" through "falsifying business expenses, reporting false filing statuses and qualifying children or dependents, claiming false education and residential energy credits and fabricating erroneous itemized deductions, including medical and dental expenses, charitable deductions and impairment-related work expenses."

The DOJ said that Frias "acted as a ghost preparer," which is someone who did not sign a tax return in an attempt to avoid being caught by the IRS, despite being legally required to do so with a valid Personal Tax Identification Number. More information about ghost preparers can be found here.

Frias and his businesses consented to the injunction which requires them to send a notice to each customer that they assisted with tax returns between Jan. 1, 2018 to present day. The order also demands that they post a copy of the injunction at the locations of each business, as well as on any of their websites or social media platforms.

The DOJ warns that anyone looking for tax return assistance should be careful when choosing a preparer and use information on the IRS website to help make a decision.

Anyone who believes that people barred from preparing tax returns are violating an injunction can contact the Tax Division here.

----

Do you have a story idea or something on your mind you want to share? We want to hear from you! Email us at newstips@fox61.com.

----

HERE ARE MORE WAYS TO GET FOX61 NEWS

Download the FOX61 News APP

iTunes: Click here to download

Google Play: Click here to download

Stream Live on ROKU: Add the channel from the ROKU store or by searching FOX61.

Steam Live on FIRE TV: Search ‘FOX61’ and click ‘Get’ to download.