HARTFORD, Conn. — Gov. Ned Lamont unveiled his first package of proposals for the upcoming legislative session that includes a series of tax cuts, which he said will provide about $336 million in relief to state residents.

The Democratic governor said Wednesday he is proposing the tax cuts because the state is projecting a $1.48 billion operating surplus, which he said would enable a significant reduction in the one-time revenues built into the enacted budget.

“When I took office three years ago, Connecticut had a $3.7 billion deficit with projected deficits for many years to come, and for the sake of our economic future I made it a commitment to turn that instability around and strengthen our state’s fiscal health,” Lamont said. “Today, Connecticut has a surplus, and we did it without broad-based tax increases, and while making a historic investment in our pension obligations and leaving the rainy day fund untouched.”

He said the state’s fiscal health is “stronger than it’s been in decades.”

“I asked our budget analysts to run some numbers to determine how we can cut taxes in a realistic way that won’t negatively impact the strong fiscal standing we’ve created, while targeting those cuts for those who can benefit most,” Lamont said. “I’m hopeful that the legislature will agree that these cuts can provide relief, and this package can be the first in a series in the coming years as we continue bringing Connecticut’s fiscal stability on more and more solid ground.”

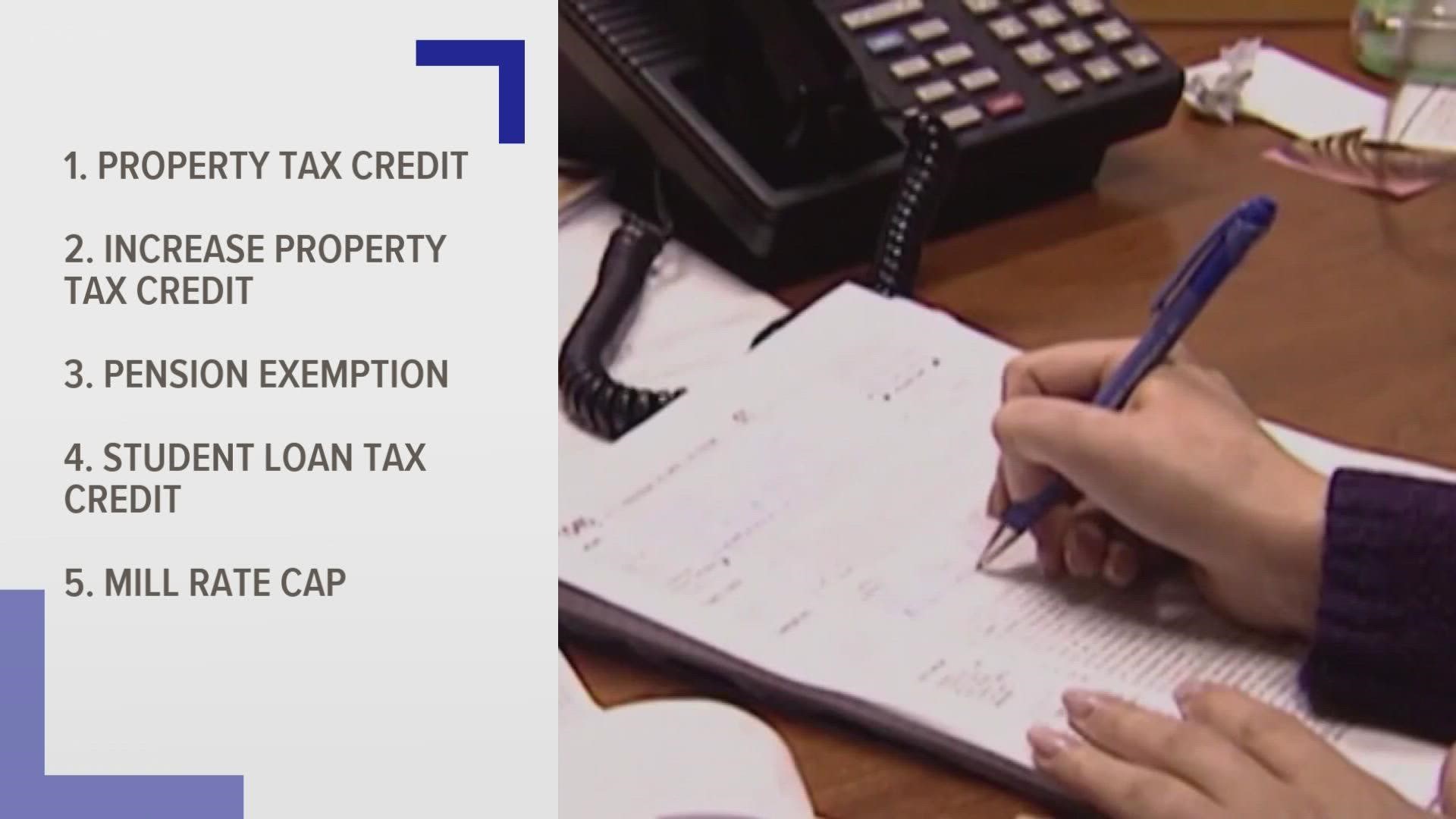

Lamont’s tax cut proposals are broken down into five parts.

The governor is asking lawmakers to immediately restore full eligibility for the property tax credit beginning in the income year 2022. He said this change would impact about 500,000 people. Under current state law, the property tax credit is limited to those over the age of 65 or those with dependents. Lamont said by expanding the credit to all adults within the current income limits, the estimated fiscal impact to the state is $53 million.

Lamont also wants to increase the property tax credit from $200 to $300, which would impact about 1.1 million people. The fiscal impact, he said, would be about $70 million.

The third tax cut proposal is accelerating the planned phase-in of the pensions and annuities exemption from income taxes, from 2025 to 2022. Accelerating the exemption three years earlier would have an estimated impact on the state of $42.9 million in FY 2023.

Lamont also wants to expand the student loan tax credit and describe motor vehicle property taxes.

House Republican Leader Rep. Vincent Candelora released a statement Wednesday, saying he can't help but feel like this "relief" package is filled with empty promises for municipal leaders and residents.

“The governor today promised residents relief from the car tax only two weeks after his budget office told cities and towns it would be unable to provide the extra money they’re supposed to receive through the Municipal Revenue Sharing Account—and this is at a time when the state is seeing record revenue collection. With that in mind, I can’t help but feel as though the 'relief' package crafted by the governor would point us toward territory that municipal leaders and residents have unfortunately grown accustomed to over the last decade: they’re promised the moon, only to see concepts yanked back entirely or retooled so much that they’re barely recognizable. I hope I’m wrong about that this time around, but the fact that his proposal fails to restore the homeowner’s property tax credit to its highest level is a signal that Governor Lamont continues to have challenges following through on fixing issues that residents care about—in this case, affordability.”

Bob Stefanowski, who is running for governor in the 2022 elections, said in a statement that Lamont's proposals "don't even begin to scratch the surface of lowering the burden of affordability" for state residents and small businesses.

"Nothing he's proposing today undoes the harm caused to every resident and business in our state," his statement said. "We can do something right now to help people where they're hurting most: cut the sales tax, eliminate Ned Lamont's tax on food and restaurants, and make gas more affordable."

This year’s session begins on Feb. 9. Leaders of the Democratic majorities in both chambers say the hearings and meetings will be held on Zoom for the first month due to the COVID-19 pandemic.

---

Have a story idea or something on your mind you want to share? We want to hear from you! Email us at newstips@fox61.com

---

HERE ARE MORE WAYS TO GET FOX61 NEWS

Download the FOX61 News APP

iTunes: Click here to download

Google Play: Click here to download

Stream Live on ROKU: Add the channel from the ROKU store or by searching FOX61.

Steam Live on FIRE TV: Search ‘FOX61’ and click ‘Get’ to download.