(CNN) — Once was a time when getting money out for the weekend meant going down to the bank branch and joining a long queue.

Since then ATMs, credit cards and internet banking have taken the place of the payday press at the grille of a bank teller.

With all the facilities of a bank now fitting into a palm-sized smartphone, the drudgery of waiting to deposit or withdraw funds has been consigned to the waste paper basket of history.

Just a swipe of the finger can now transfer funds between accounts anywhere in the world and even taking a picture can deposit a cheque.

Increasingly high street branches — many of them still occupying some of the most imposing buildings in town — are becoming expensive white elephants for many banking corporations.

One bank, however, is repurposing its more than 300 banks to bring people back to the branch; making its physical space as enticing as the virtual one.

“The branch model is outdated and not relevant any longer we’re looking to create a different kind of bank one that offers all the products and services of a large bank but delivers them with real community engagement and the service of a great retailer or hospitality company,” said Eve Callahan of Oregon-based Umpqua Bank.

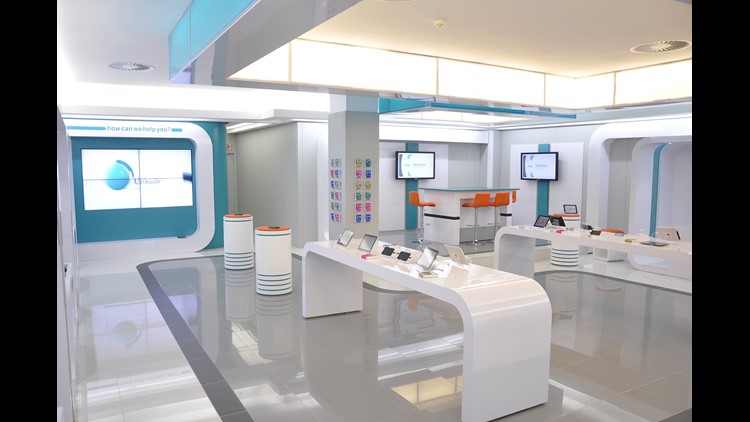

Using what it calls the store concept, Umpqua Bank aims to create for banking what Apple or Gap has done for computing and apparel — that is set up a space where customers, or just the curious, can browse, rest or come in and do some banking.

Umpqua’s store in San Francisco is the latest manifestation of the project.

The slick, modern and comfortable space provides information on a touchscreen (what it calls a Catalyst Wall) rather than on the traditional brochures. Customers that want a meeting room can use one of Umpqua’s at no cost.

Even if all you want is a cup of coffee and some free WiFi, then Umpqua’s doors are always open.

Ultimately, banking is based on trust and Umpqua has found its local branches a perfect place to build that relationship.

“There’s no pressure that you’re not a customer with us. We welcome everyone regardless of whether they have a relationship with us or not,” said Abdul Sanger, Universal Associate, at Umpqua Bank.

The model is now being emulated by large banks such as Chase, Citibank and Barclays, all anxious to rebuild the face-to-face relationships that have been lost in the internet age.

“How companies come up with a model that captures a truly integrated customer experience,” said Callahan. “I think those companies are the organisations that will really win in the future.”