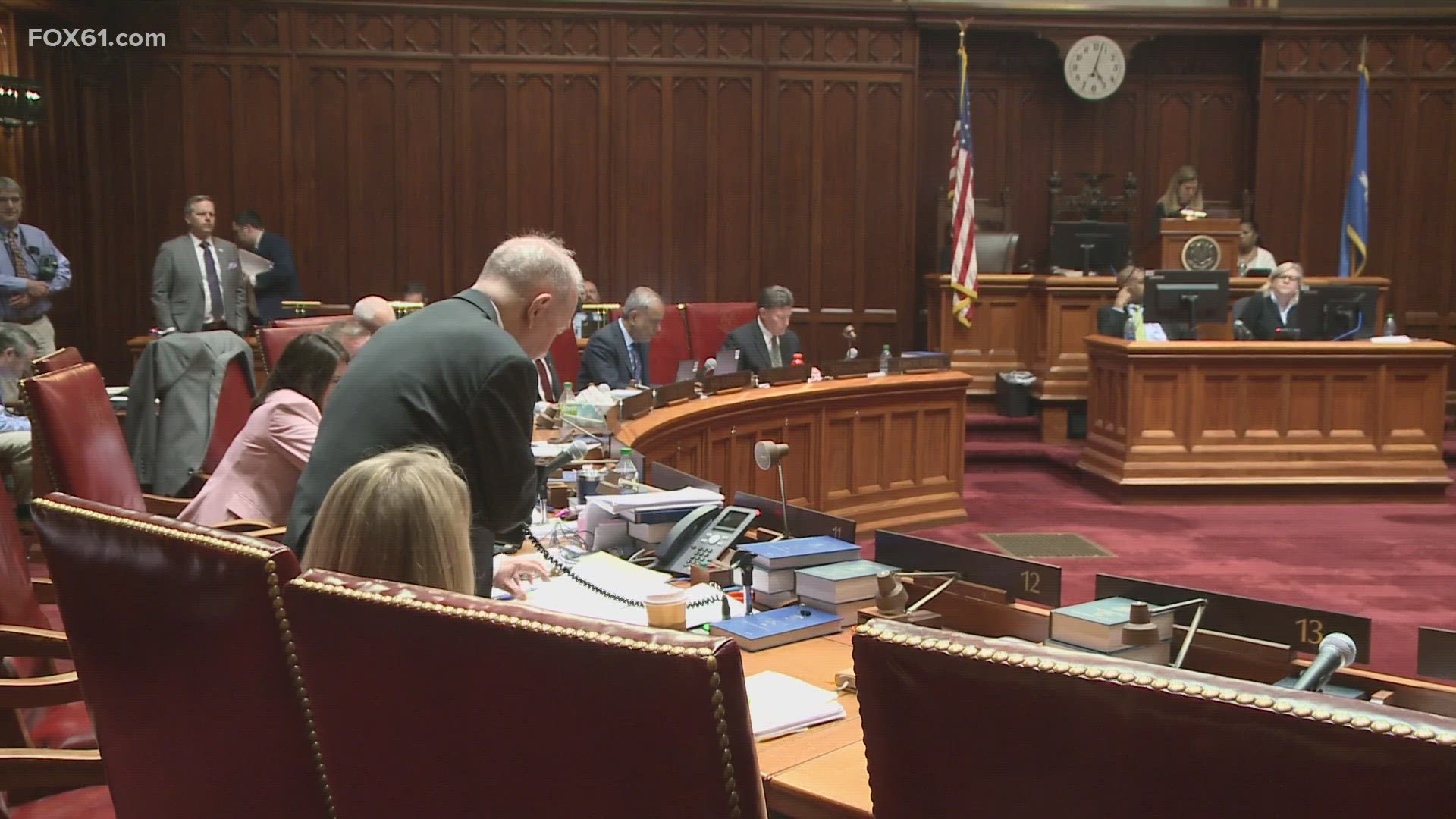

HARTFORD, Conn. — A two-year, $51 billion state budget with a historic cut to Connecticut's personal income tax was passed the state Senate with nearly unanimous bipartisan support on Tuesday, hours after the House overwhelmingly passed the same legislation.

Both Democrats, who control the General Assembly, and minority Republicans expressed support for the massive bill — described by one senator as a Russian novel. It boosts funding for public schools in hopes of addressing student's educational setbacks during the pandemic and lowers marginal income tax rates for the first time since 1996.

“Is this package perfect? No. Are there a lot of needs? Yes. We give money back to our taxpayers. Could we have done more? Maybe,” said Sen. Henri Martin, the top Senate Republican on the Finance Revenue and Bonding Committee. “I think this is a fair document, a good document.”

Other Republicans, however, argued that the tax cuts don't go far enough to make Connecticut more affordable.

“We could have, and should have, done so much more,” said Sen. Eric Berthel, the top Republican on the legislature's Appropriations Committee.

The only no vote in the senate came from Republican Sen. Rob Sampson.

"This isn’t it. It’s more of the same, it’s big government. It’s too much spending and too much taxes for Connecticut residents," Sampson said.

The Senate began debating the bill late Tuesday morning, the penultimate day in a six-month legislative session marked by bipartisan votes on some key bills. The tax-and-spending package passed 139-12 in the Democratic-controlled House early Tuesday after a nearly three-hour debate that started late Monday.

First proposed by Democratic Gov. Ned Lamont, the planned income tax reduction is predicted to benefit approximately 1 million of the state’s 1.7 million tax filers. It’s being billed as the largest reduction since the tax was first implemented in 1991.

“This budget will deliver the largest personal income tax cut in the state’s history,” Lamont said in a written statement issued before the vote. “This is not a temporary tax cut – it is designed to be sustainable for years to come.”

While the budget increases spending by about 7.5% over two years, it also remains under the state's cap on spending. Lamont has said the state’s fiscal health has improved to the point where it can afford to provide permanent tax relief. The plan lowers the 5% marginal income tax rate to 4.5% and the 3% rate to 2% for the income year 2024.

The plan also increases the income tax credit for low-income working families, benefitting about 211,000 filers, and freezes scheduled increases in the state diesel tax.

The two-year tax-and-spending package also boosts state aid for local school districts by an additional $329 million; funds the “baby bonds” program that sets aside up to $3,200 for infants in low-income families; creates a new 30% tax credit for pre- and post-Broadway productions; increases funding for ambulance services and child care providers; increases pay for inmates; and expands an anti-gun violence program to more cities.

"We’re going to have lower tax rates than all the neighboring states around us. This is the place you want to be, Lamont said on Tuesday.

It also provides funding for striking group home workers who've been holding a vigil at the Capitol in recent days. Additionally, it includes funds to reduce a waiting list for residential services for people with developmental disabilities; and restores Lamont's planned cuts to Metro-North commuter rail in fiscal year 2025. It also includes additional funding for nonprofit social service agencies and state colleges and universities, although advocates contend it’s not enough considering the state’s resources.

Democratic Rep. Greg Haddad, co-chair of the legislature's higher education committee, said during the House debate that even though he was voting for the bill, it still falls short. Haddad also criticized the budget for using one-time revenues to cover costs at the state schools.

“It's like we've found the potholes in the road and we've filled them with snow, and spring is coming,” he said.

There are also concerns about whether there's enough money for the state’s new early voting program, which is expected to affect general elections, primaries and special elections held on or after Jan. 1, 2024. And advocates for low-wage workers argued that Lamont's “dogmatic insistence on a rigid implementation of Connecticut's spending cap” means only “small steps” are being made to meet the needs of the vast majority of residents.

“Indeed, in some cases it actually moves backwards — leaving critical programs closed due to understaffing, threatening layoffs, service cuts, and tuition freezes in public higher education,” according to a statement from the Recovery for All coalition.

Last week, state Comptroller Sean Scanlon projected the current fiscal year, which ends June 30, will finish with a $1.6 billion budget surplus, an increase of $16 million from May. The budget deposits $3.3 billion into the state’s budget reserve account.

The new budget, expected to be signed into law by Lamont, would take effect on July 1.

---

Have a story idea or something on your mind you want to share? We want to hear from you! Email us at newstips@fox61.com

----

HERE ARE MORE WAYS TO GET FOX61 NEWS

Download the FOX61 News APP

iTunes: Click here to download

Google Play: Click here to download

Stream Live on ROKU: Add the channel from the ROKU store or by searching FOX61.

Steam Live on FIRE TV: Search ‘FOX61’ and click ‘Get’ to download.