HARTFORD, Conn — Three “significant” tax relief measures will take effect in the New Year that officials say will help reduce taxpayers’ burden by more than $460 million, officials announced Wednesday.

The measures include reducing the state’s income tax rate, increasing the tax credit for low-income workers, and expanding exemptions on certain pension and annuity earnings benefits for seniors. It is the first time that tax rates have been reduced in Connecticut since the mid-1990s.

On Wednesday, Gov. Ned Lamont said these measures were enacted to “provide board-based tax relief to those who need it.”

“These tax cuts are possible due to the fiscal discipline that we’ve implemented over the last five years, which has stabilized the state’s fiscal house and ended a trend of too many years of deficits and uncertainty,” he said.

The Connecticut General Assembly approved these tax cuts for the 2024-2025 state budget.

So, what does it mean for Connecticut taxpayers?

Income tax cuts

The changes enacted will see a decrease in the two lowest tax rates.

The 3% rate on the first $10,000 earned by single filers and the first $20,000 by joint filers will drop to 2%. The 5% rate on the next $40,000 earned by single filers and the next $80,000 by joint filers will drop to 4.5%.

Officials said these tax cuts target middle-class taxpayers and are capped at $150,000 for single filers and $300,000 for joint filers. It is the largest income tax cut enacted in state history.

More than 1 million taxpayers will be impacted by this cut.

Click here for an income tax breakdown for single filers and joint filers.

Earned income tax credit increase

Connecticut’s new Earned Income Tax Credit (EITC)change took effect retroactively for 2023 and will become available when residents file their personal income tax returns in early 2024.

It is increasing from 30.5% to 40% of the federal EITC. Officials said this increase will provide an additional $44.6 million in state tax credits to about 211,000 low-income filers who receive the credit.

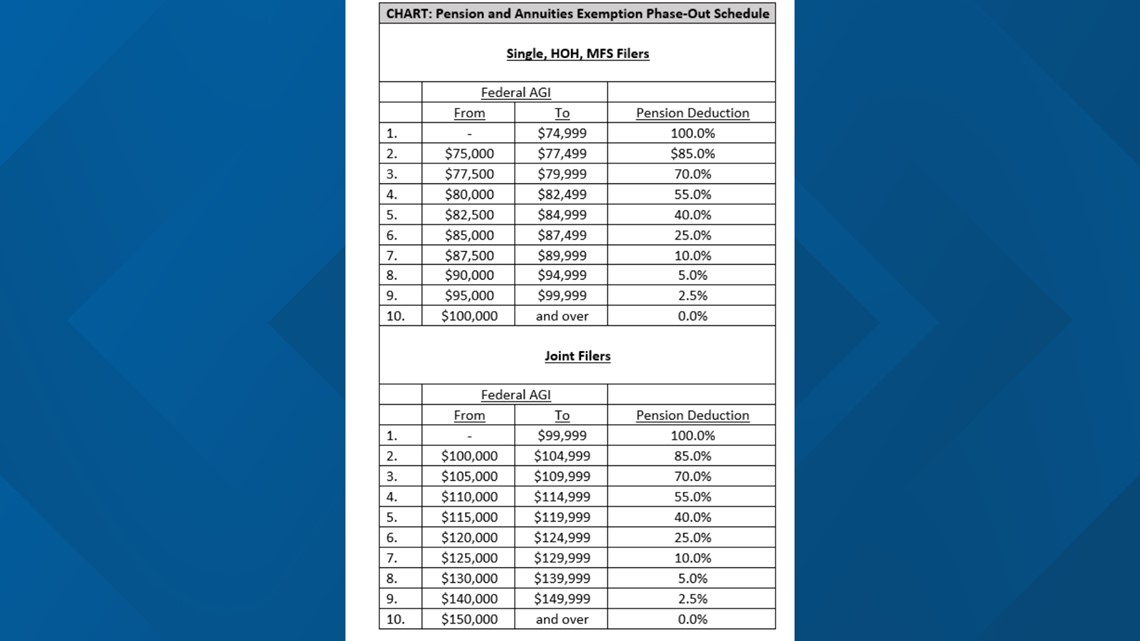

Expanding senior pension exemptions

The state budget eliminates the retirement income tax cliff by adding a phase-out for allowable pension annuity and IRA distribution deductions against the personal income tax.

Currently, about 200,000 Connecticut seniors benefit from the current exemption limits and this change will benefit an additional 100,000.

Republican reaction to tax relief

Senate Republican leader Sen. Kevin Kelly said in a statement that while the $600 million in tax cuts is a "good start," people should not forget about Connecticut residents who are in need.

"Senate Republicans have always been focused on providing tax relief for struggling working and middle class families. That’s why we proposed $1.5 billion in tax cuts – the largest income and property tax cut in Connecticut’s history – this spring. Unfortunately, our proposal to help these families did not gain favor with the majority," he said in part. "Too many of our neighbors cannot afford the basics: heat, health care, groceries and medical costs. People are deciding every day whether to heat their homes or put on food on the table. They are struggling with the high cost of inflation, especially at the grocery store. More can - and must - be done to provide these families with the relief they need.”

---

Have a story idea or something on your mind you want to share? We want to hear from you! Email us at newstips@fox61.com.

---

HERE ARE MORE WAYS TO GET FOX61 NEWS

Download the FOX61 News APP

iTunes: Click here to download

Google Play: Click here to download

Stream Live on ROKU: Add the channel from the ROKU store or by searching FOX61.

Steam Live on FIRE TV: Search ‘FOX61’ and click ‘Get’ to download.