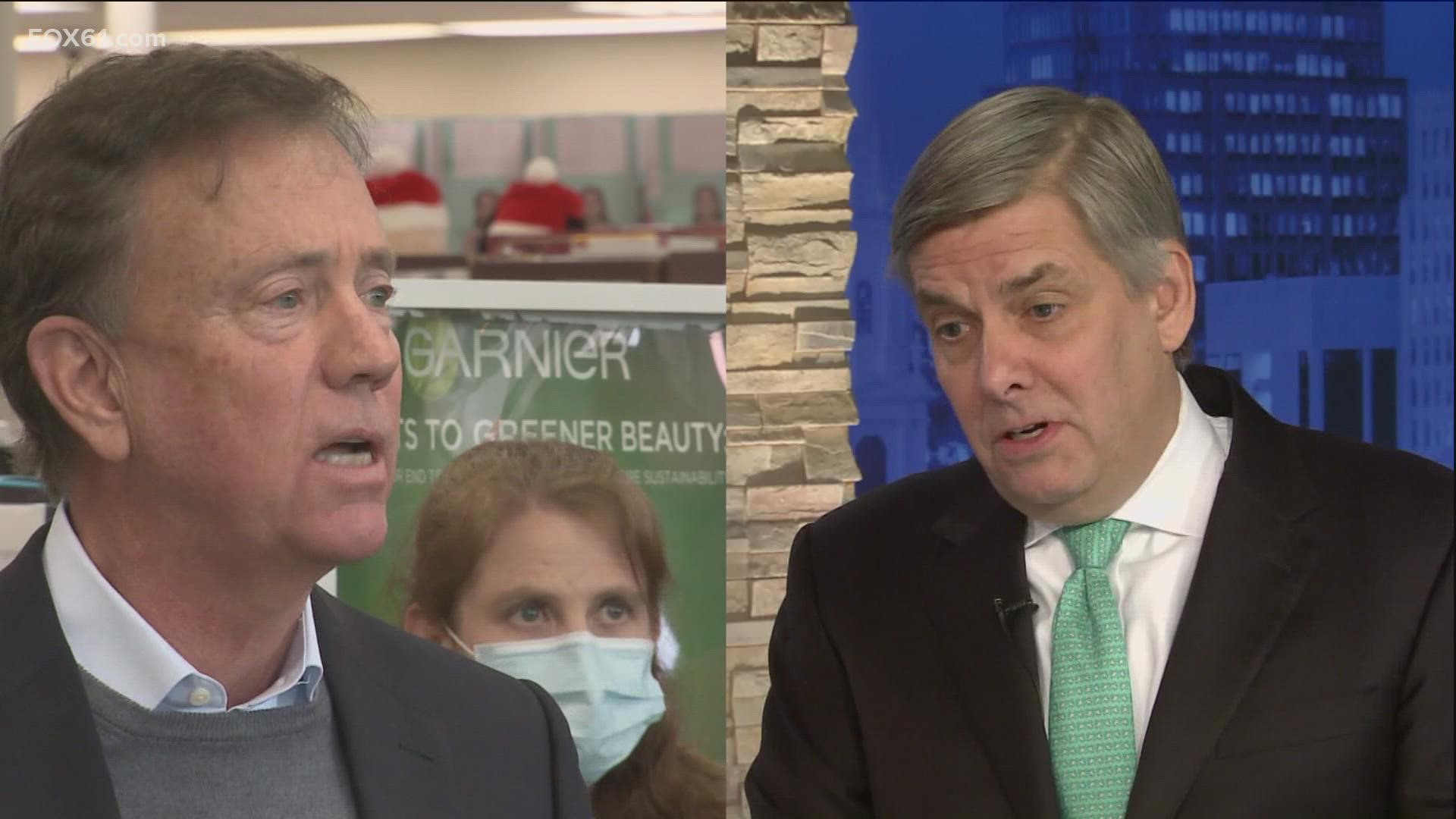

HARTFORD, Conn. — Friday, Gov. Ned Lamont (D-Connecticut) released his 2021 federal and state tax returns, showing he made over $54 million last year.

Reporters were allowed to look at and take notes of the tax documents but were not permitted to photograph them or bring cameras into the room.

“He is the least transparent governor in certainly our recent, if not ever, history,” said Republican candidate for lieutenant governor Laura Devlin.

After a week of back and forth about transparency between Lamont and Republican challenger Bob Stefanowski ending in the release of Lamont’s 2021 federal and state tax returns.

He paid over $12.8 million in federal taxes and more than $3.7 million in state taxes on an adjusted gross income of about $54 million.

That’s a combined tax rate of 25%.

His charitable contributions totaled over $1.6 million across 15 different organizations.

In a statement, Jake Lewis, communications director for Lamont's campaign wrote:

“Governor Ned Lamont is continuing his record of being transparent with Connecticut residents, something he believes all candidates should do. He has gone above and beyond what is required – placing his assets in a blind trust and reporting his holdings each year to the state ethics office.

This year's returns, like previous ones, show that he has both paid substantial taxes and made meaningful charitable contributions each year during his first term in office. Governor Lamont remains focused on putting money back in the pockets of middle-class families, keeping our state’s fiscal house in order, and making sure Connecticut stays the best state in the nation to live, work, and start a family.”

Stefanowski disagreed.

“Why is he hiding the majority of the family income? Why don't the taxpayers have a right to know that?” Stefanowski posited Thursday.

Lamont files separately from his wife, Annie–her occupation on the returns is listed as “venture consultant.”

Last month, Stefanowski released his returns for the last three years, showing he and his wife Amy earned over $13.1 million in 2021.

They paid more than $5.2 million in federal taxes that year.

Lamont and Democrats this week criticized Stefanowski for earning some of that money through consulting work on a project backed by the Saudi Arabian Crown Prince.

“It sounds like Bob is still on the payroll at the same time, he's a candidate for public office,” Lamont said last week. “I'm not quite sure if he's really working it right now or not. I think he's campaigning pretty much full-time, but it does lead the questions.”

Stefanowski claims Lamont is concealing family income by filing separately from his wife, pointing to her investments in a company previously contracted with the state to conduct COVID-19 testing.

“I don't know anybody who files married filing separately,” he said. “What is he hiding?”

There isn’t an actual requirement for gubernatorial candidates to release their tax returns publicly, but it’s become a common practice.

Emma Wulfhorst is a political reporter for FOX61 News. She can be reached at ewulfhorst@fox61.com. Follow her on Facebook, Twitter and Instagram.

---

Have a story idea or something on your mind you want to share? We want to hear from you! Email us at newstips@fox61.com

----

HERE ARE MORE WAYS TO GET FOX61 NEWS

Download the FOX61 News APP

iTunes: Click here to download

Google Play: Click here to download

Stream Live on ROKU: Add the channel from the ROKU store or by searching FOX61.

Steam Live on FIRE TV: Search ‘FOX61’ and click ‘Get’ to download.