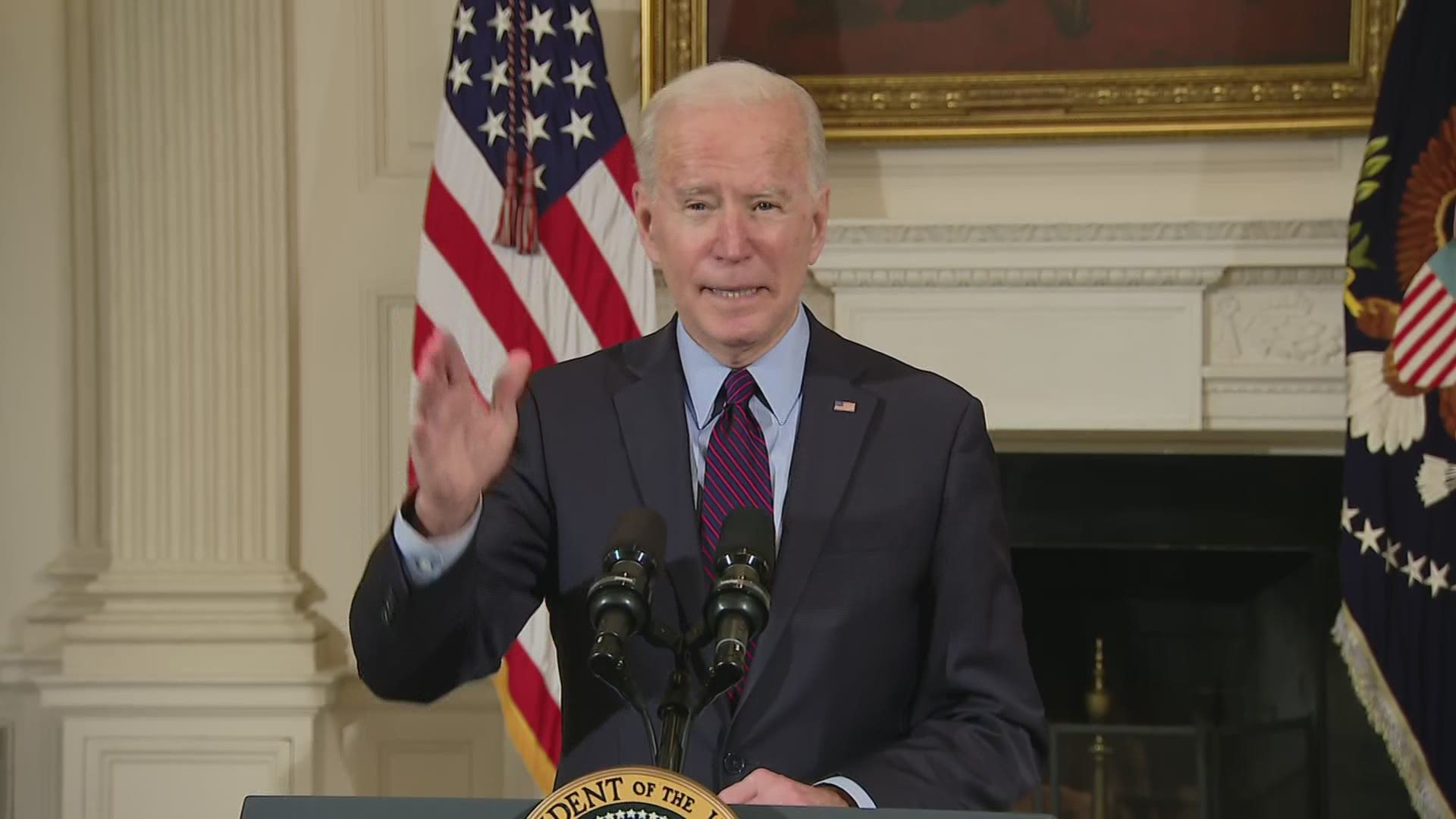

WASHINGTON — The House of Representatives passed the final vote for the $1.9T stimulus bill March 10, with President Joe Biden expected to sign later this week.

The stimulus package, dubbed the “American Rescue Plan”, is aimed at providing financial aid not only to families and individuals, but also to help aid businesses, schools and local governments amid the pandemic.

The Verify team has gotten lots of questions from viewers asking what's in the bill and who might be seeing payments this time around.

Here's a breakdown of what to expect:

Who qualifies for this round of the stimulus checks?

Like we mentioned before, we're still waiting for the final legislation to pass the Senate, meaning there could be some room for these guidelines to change.

But for right now, this stimulus check is slightly different than the ones we have seen before. This round of checks would give $1,400 dollars to a single taxpayer and would double that amount to $2,800 for married couples who filed together.

The payments are reflected off of your 2019 or 2020 income and depend on when you filed your 2020 taxes. The IRS relies on your most recently filed tax return to help distinguish when, and how much, you might get.

In addition, the checks are based on your Annual Gross Income (AGI), which is your gross income minus certain deductions like 401k or health savings account contributions. It's why your income might be listed slightly lower after taxes.

What makes this round of checks different?

This round of checks would offer $1,400 payments for both child dependents and non-child dependents —unlike the first two rounds of stimulus, which paid out only for those under the age of 16. So those who may have been skipped in previous rounds, like college students or others claimed as a dependent for tax purposes, might qualify for a check.

But there are some limitations. You would only qualify for the full $1,400 if you make up to $75,000 a year -- after that, you would receive a smaller stimulus check, with a hard cut-off at $80,000 for individuals or $160,000 for married couples filing jointly.

I already received a stimulus check. Do I need to report it on my 2020 taxes?

Well, what if you’ve already received a stimulus check from the first two rounds? Do you need to report your stimulus checks from 2020 on your tax return?

We can Verify this is false -- you don't need to report any of your stimulus checks from 2020 on your tax returns, because they aren't considered taxable income.

Cari Weston, an accountant with the American Institute of Certified Public Accountants, told the Verify team that the checks “are not considered taxable income...and will not be reported as such on 2020 tax returns."

Technically, the CARES Act lowered the tax liability for last year, which means most people would have gotten a larger refund when they filed their 2020 taxes this year. But instead of waiting to send payments, the IRS issued those refunds as stimulus checks.

Does the bill have a child tax credit?

RELATED: VERIFY: Yes, you may qualify for a tax rebate if your stimulus check was less than you expected

Again, specific provisions inside the bill might change as it goes under Senate voting. But as it stands currently, there is a provision that would institute a refundable child tax credit for 2021. This would increase the amount given for children between the ages of 6-17 from $2,000 to $3,000 per kid and increase the amount up to $3,600 for kids under the age of six.

Like the stimulus checks for individuals, the payments would gradually phase out if you're making more than $75,000 a year, or for married couples earning more than $150,000.

When is the bill going to pass?

The Senate is expected to begin working out plans for the bill by the end of the first week of March, including negotiations over certain language and stipulations.

But Democrats are urging for the bill to be passed before March 14, which is when certain weekly unemployment aid is set to expire. The new relief package would increase those weekly benefits from $300 to $400 and extend payments through September, in the hopes of preventing a lapse in aid.

Democrats are using a process called budget reconciliation to pass the legislation. It's a fancy term that means they would only a simple majority in the Senate for approval instead of the usual 60 votes required to overcome a potential filibuster.

The Verify team explained the whole process and how it might allow Democrats to pass the COVID-19 relief on their own, even though Senate conversations might derail and lengthen the process, here.

Have a question? Send it to our Verify team at VERIFY@wusa9.com or by text at 202-895-5599.