HARTFORD -- A public hearing took place Tuesday at the Legislative Office Building in Hartford for Connecticut residents who wanted their opinions to be heard about several proposals lawmakers are considering to raise taxes.

The proposals include increasing Connecticut's sales tax and bumping up the amount of the wealthiest currently pay in the state.

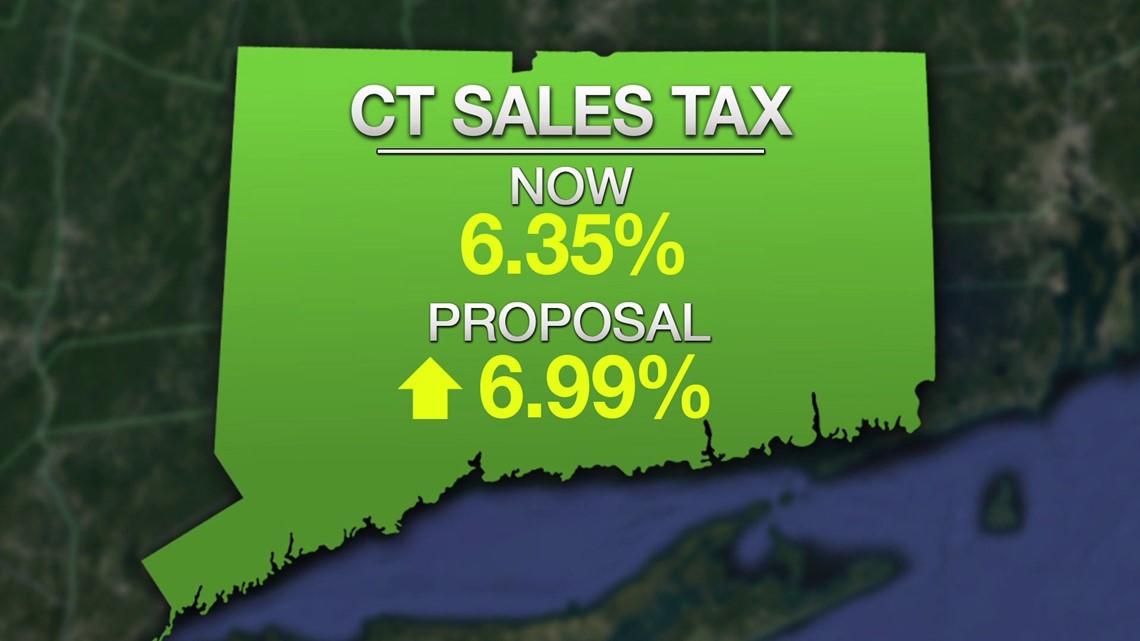

Right now, in the state, the sales tax is 6.35 percent. A proposed bill would raise that to 6.99 percent.

When looking at Connecticut's nearby states, New York State has higher sales tax rates than states in New England. New York State has a four percent state sales tax on top of a county sales tax. For example, the total sales tax in neighboring Westchester County is 7.375 percent, with the County requiring its own three percent tax. Dutchess County’s combined sales tax rate, including state tax is 8.125 percent.

As for the other nearby states, Rhode Island is currently at seven percent, Massachusetts is at 6.25 percent, Vermont is at 6 percent and Maine at 5.5 percent. New Hampshire does not have sales tax.

Meanwhile, another proposal raises the income tax rate on Connecticut's wealthiest residents. This would impact those making more than $500,000 if filing single annually. If you file jointly, it would be for couples making more than $1,000,000. They are now paying 6.99 percent and a proposal would raise that to 7.49 percent, the highest its been since the tax was introduced more than 25 years ago.

Governor Dannel Malloy didn't propose either tax hike in the budget he presented several months ago.

"Too much thought is going into how to raise additional money and too little thought going into how do we live within our approximate means," said Malloy.

On Friday, Malloy reiterated he's not for raising taxes again and he's going to wait and see what lawmakers come up with.

"I'm in a position where they haven't put anything on the table yet. The committees of cognizance have not finished their work," said Malloy. "They have the right to do that. I'm trying to be respectful of that process. We'll see whether they can get that done. We'll see where we stand week after next and we'll see based on where we stand where we go."